R&D technology – tech enabled service delivery to rethink your claims

R&D technology – tech enabled service delivery to rethink your claims

Changes to R&D tax credit regulations are coming soon, and HMRC are increasingly scrutinising claims. Whatever industry your business operates in, there are opportunities out there to leverage technology to gain insights into your R&D tax credit claim.

There is no more pertinent time to rethink your approach to R&D claims so that you can be certain they are right first time, every time.

Our R&D tax consultants can enhance your RDEC and SME claim process

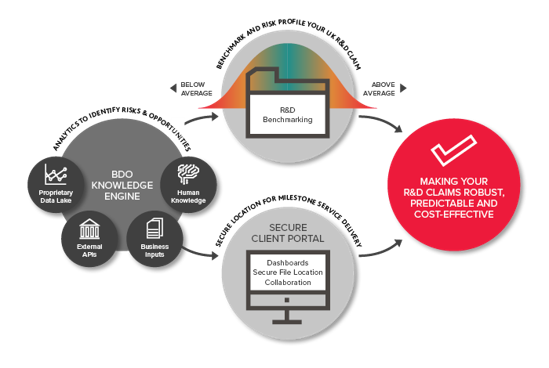

Our national R&D team is made up of engineers and tax professionals who specialise across a wide range of sectors. We have developed market-leading systems and tools that integrate with public APIs to support the evaluation and execution of your tax credit claim process. Our offering commits to enhancing the quality of your claim, and the future security and efficiency of your claim process. We go over and above to identify the risks and opportunities posed by your claim specifics (e.g. R&D sector, R&D resource type), and across your wider tax compliance profile.

Is your R&D tax credit claim putting your business at risk?

In an environment of increased scrutiny, making sure your claim is credible and robust is more important than ever.

Our AI powered R&D tax credit benchmarking tool can ensure that your business’ claim is aligned with your company profile and indicate whether you could come under pressure from HMRC based on your claim specifics. We can also assess whether your business is at risk of under-claiming, based on industry benchmarks. Using a combination of HMRC, business intelligence and our own data streams, the report provides data-driven, quality insights that provide real value to your business.

Based on the report, our team of R&D tax specialists can go even further with suggestions on:

- Why your R&D tax relief benefit differs from your competitors or the industry sector average

- The likelihood of your claims being queried by HMRC or investors on a listing, fund raising or exit

- The factors that influence your R&D risk profile

- Specific places where it is likely you have underclaimed on R&D costs

- Claim methodology and project analysis to give you insights into a robust R&D process for the future that both reduces your risks and enhances your returns.

For large businesses, risk reviews of RDEC claims can form an important part of your SAO annual assurance procedures for tax compliance – reviewing and benchmarking your claims through a third party helps to demonstrate to HMRC that you are taking your tax compliance seriously.

Get your R&D tax claim assessed

Efficient processes through our secure Client Portal

Using our secure portal for your R&D claims allows us to work with your team, leveraging data capture processes to facilitate collaboration, due diligence and reporting. The portal gives your management team dashboards to easily establish delivery milestones and track claim progress.

For help and advice on rethinking your approach to R&D claims, please contact Radeep Mathew.