Maria Mason

We understand the complexities, resources and expertise required to deliver payroll and HR solutions in the UK and internationally for your employees’ entire journeys. Whether you are an ambitious, entrepreneurial business looking to take on your first employees or a larger organisation looking for a complete HR, workforce management and outsourced payroll solution, we will help.

Our ambition is to remove the distraction and complexity of payroll regulation and processes so you can focus on achieving your business goals.

“Our challenge was to find an HR solution that meets the business needs right now and allows us to scale up our growth plans based upon our franchise model. This would not have been possible with our old systems and daily time-consuming workarounds.

“Our challenge was to find an HR solution that meets the business needs right now and allows us to scale up our growth plans based upon our franchise model. This would not have been possible with our old systems and daily time-consuming workarounds.

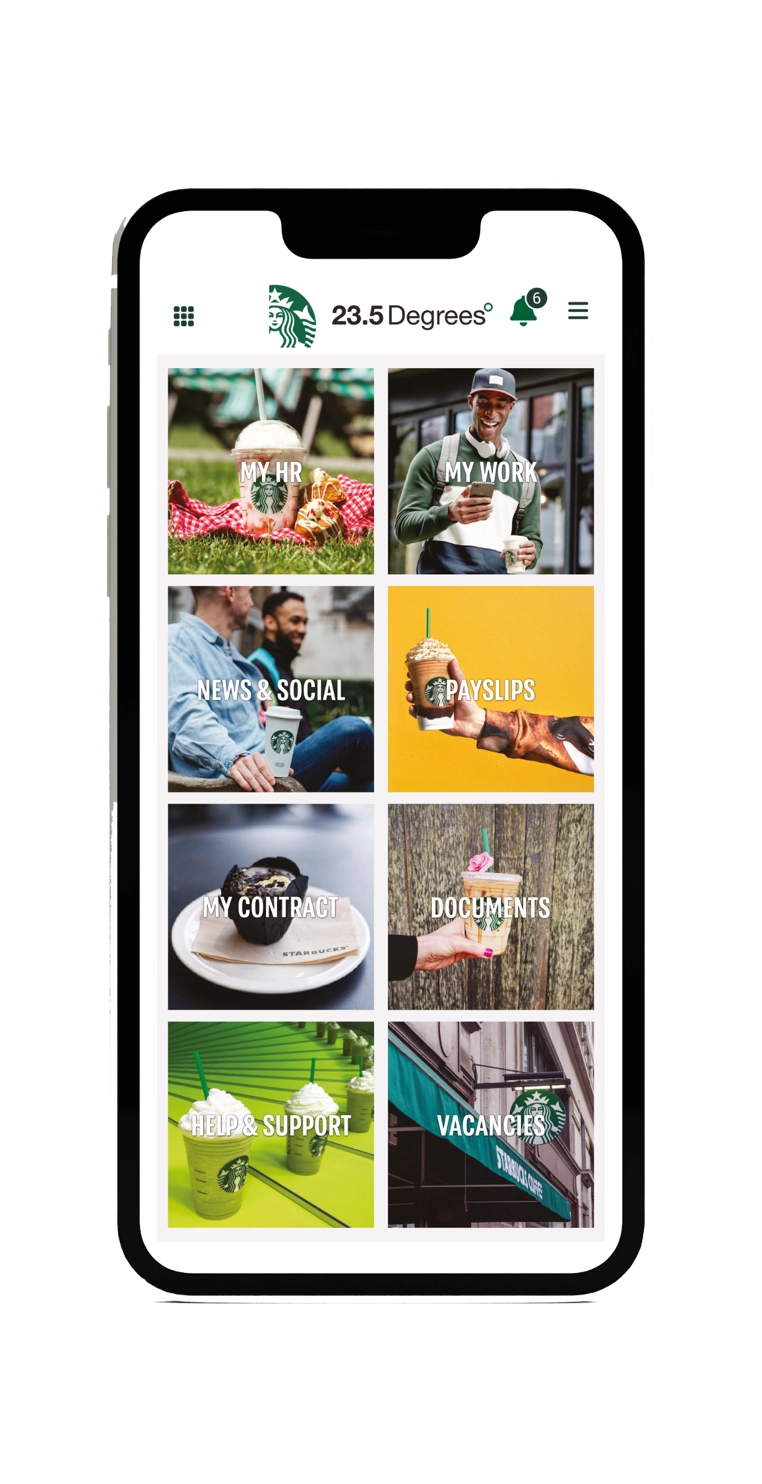

BDO & elementsuite’s full-suite employee life-cycle solution has saved 23.5 Degrees not only valuable time but has removed numerous workaround processes and thereby allowing our partners to spend more time with their customers. Our partners love it because it’s easy to use and can be accessed anytime through their mobile devices.”

CEO, 23.5 DEGREES

As a full-service accounting and advisory firm, we bring the expertise and insight that will empower you to deliver your payroll and HR more efficiently and effectively, bringing together data, technology, specialist services and additional advisory services to support your wider business needs:

National Payroll Services:

We support businesses that are looking for a simpler, more efficient way of managing their payroll, allowing them more time to focus on growing their business — download our BDO National Payroll Services brochure to learn more.

People & Payroll Solutions:

We can help you transform your people and payroll function, delivering payroll and HR systems and processes that address the needs of your business and empower your people to succeed — download our People & Payroll Services brochure to learn more.

everyday — pay, HR & workforce management:

An innovative, AI-assisted pay, HR and workforce management solution, developed by elementsuite and BDO for businesses with 250 – 1,000 employees — discover the benefits of everyday.

Payroll on Point Newsletter:

Subscribe to our Payroll on Point newsletter to receive the latest news and developments from UK payroll.

Global Payroll Services:

For multi-jurisdiction payroll, our Global Payroll Services team will ensure payroll services are coordinated and compliant across the globe.

| Service | Data | |

|---|---|---|

|

| |

| Technology | Advisory | |

|

|

Maria Mason