Scope 3 - What is it, and what do you need to know?

Scope 3 - What is it, and what do you need to know?

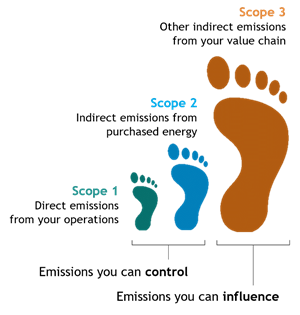

Climate change strategies are becoming ever more critical to business. Whether for compliance with mandatory reporting requirements, for demonstrating business resilience to investors, meeting customer expectations around environmental performance or simply managing risk and opportunity, businesses increasingly rely on robust and verifiable greenhouse gas reporting. The Greenhouse Gas (GHG) Protocol is a family of carbon accounting standards that has become pre-eminent. It groups emissions into three ‘scopes’. Scopes 1 and 2 are the best understood, being direct emissions from operations and indirect energy-related emissions respectively, and these are already widely measured and reported. However, Scopes 1 and 2 do not account for the full climate impact of an organisation. This requires Scope 3, which captures all the other indirect emissions caused by an entity but physically occurring elsewhere in its value chain.

Full Scope 3 reporting is required for organisations wishing to set net zero targets validated by the Science-based Targets Initiative for example and underpins a holistic assessment of climate-related risk and opportunity as required by the Taskforce for Climate-related Financial Disclosure.

Calculating these 15 categories is complex. Just as the reporting organisation does not directly control activities giving rise to scope 3 emissions (by definition they are emissions under the control or ownership of third parties), the reporting organisation typically doesn’t have access to all the data required to monitor them.

What are Scope 3 emissions?

Scope 3 captures all the other indirect emissions caused by the reporting entity not included in scopes 1 & 2. It is divided into ‘upstream emissions’ – most easily understood as those associated with things the organisation buys, and ‘downstream emissions’ – those resulting from things the organisation sells. There are 15 categories in all, capturing a complex landscape of ‘value chain emissions’.

Scope 3 emissions can make up more than 90% of a company’s carbon footprint and are therefore crucial to net zero and sustainable business strategies.

Scope 3 emissions categories

Upstream emissions

Upstream emissions are emissions attributable to the reporting company from:

- Goods and services purchased by the company

- Capital goods

- Fuel and energy-related activities (not included in scope 1 or scope 2)

- Upstream transportation and distribution

- Waste generated in operations

- Business travel

- Employee commuting and home working

- Upstream leased assets

Downstream emissions

A business’ downstream emissions come from the use and disposal of their products or services. These are:

- Downstream transportation and distribution

- Processing of sold products

- Use of sold products

- End of life treatment or disposal of sold products

- Downstream leased assets

- Franchises

- Investments

How to calculate your Scope 3 emissions

There are four calculation methods recommended by the GHG Protocol to help calculate your Scope 3 emissions for each category. These are designed to work with the best available data for each category, noting that sometimes this can be low quality data. You must declare the calculation methods you used in your reporting, so it is important to choose the right method for each one.

To determine which method to use, review the methods in relation to the below criteria to ensure your emissions are reflected appropriately:

- The relative size of the emissions from the scope 3 activity, compared to scope 1 and 2

- Your company’s goals

- The availability of the data

- The quality of your data

- The cost and effort that would be required to apply each method

The four methods for calculating Scope 3 emissions are:

The Spend-based method combines primary expenditure data with spend-based emission factors for the goods or services purchased.

The Average data method uses a combination of primary activity data on the mass or quantity of products purchased, and secondary emission data for the purchased products by unit.

The Hybrid method combines activity or emissions data provided by suppliers with spend-based calculation to fill in any gaps.

The Supplier-specific method combines primary activity data on the mass or quantity of the products you purchased from specific suppliers with primary product and supplier-specific emissions per unit.

How to reduce Scope 3 emissions

While challenging, businesses can look to reduce their scope 3 emissions in several different ways that will vary based on size, sector, and business model.

A good place to start would be to consider some of the areas below:

- Sourcing materials: Consider increasing the amount of recycled and re-used materials for your products and packaging. By using more recycled materials you will avoid the Scope 3 emissions that come from the use of virgin materials

- Supply Chain: Examine the business models and production methods of your suppliers. Suppliers that use less energy, raw materials, and resources will mean lower Scope 3 emissions for your business. You should consider ESG factors when selecting and reviewing suppliers and try to use those with the best sustainability records. Consider collecting emissions data from your suppliers as part of your procurement processes to help speed up your ability to track and reduce your Scope 3 emissions against benchmarks. For suppliers where you hold significant purchasing power or a highly strategic relationship, consider placing contractual obligations on them to set zero targets or meet product-specific decarbonisation criteria.

- Increase Product Lifespan: Moving your production to focus on reducing the lifecycle emissions of your products. If the majority of the lifecycle emissions are in the manufacture phase, try to increase the product lifespan and moving towards a more circular business model, for example by minimizing disposal and moving to repair, reuse, recovery or recycling schemes. For products that have high in-use emissions (e.g. white goods, internal combustion engine vehicles, etc.) try to accelerate the transition to low carbon, high energy efficiency and renewable energy products. Find out more about how the emerging circular economy is affecting M&A trends.

- Logistics: Consider using more sustainable logistics options, transportation companies that provide a higher % of electric or a hybrid fleet for example. Reviewing your logistics approach alongside your supply chain could highlight opportunities to reduce emissions by reducing distances or creating efficiencies.

- Business travel: If you provide company cars, accelerate the switch to electric vehicles. Provide employees with sustainable travel guidance and consider ways to reduce the use of flights, for example by using teleconferencing facilities and an internal cost of carbon. If you have a significant employee-base working from home, think about how you can help them decarbonise their home work space. Consider setting up employee discounts for renewable energy and providing information on greening the home.

- Investments: If you hold equity in other ventures, consider how you can incentives them to decarbonise. Review your pension investments and consider providing employees with access to low carbon pension funds.

When it comes to reducing Scope 3 emissions, it is important to focus on what matters most and be aligned with your stakeholders and suppliers on deliverables and objectives. To make a meaningful impact, you should prioritise the ‘hotspots’ or areas in which you can have the greatest impact. These might be the largest categories of emissions, or targeted suppliers or products that have a particularly high emissions intensity.

Do you need help calculating and reducing your Scope 3 emissions?

Taking a strategic and collaborative approach to emissions reduction across the value chain can help to create a more sustainable and resilient business, while also delivering business benefits such as reduced costs, increased efficiency, and enhanced reputation.

Accurate assessments enable you to confidently identify the material emission sources and develop emissions reduction strategies. We can support you with GHG assessment and validation to help you identify, implement, and monitor emissions reductions and help you help you use effective calculation methods for measures for you and your value chain.

To discuss how we can help your business assess your Scope 1, 2 and 3 greenhouse gas emissions, get in touch with our expert team.