Pensions - retirement and inheritance planning

Pensions - retirement and inheritance planning

Changes to the pension schemes rules in April 2015 and 2016 offered a new option for individuals to consider as part of their retirement and succession planning strategy.

There is no longer a limit on the amount you can hold in your pension pot, see further here: Lifetime Allowance (LTA)

In this article we summarise the options that are available and their impact for tax purposes.

Accessing your pension

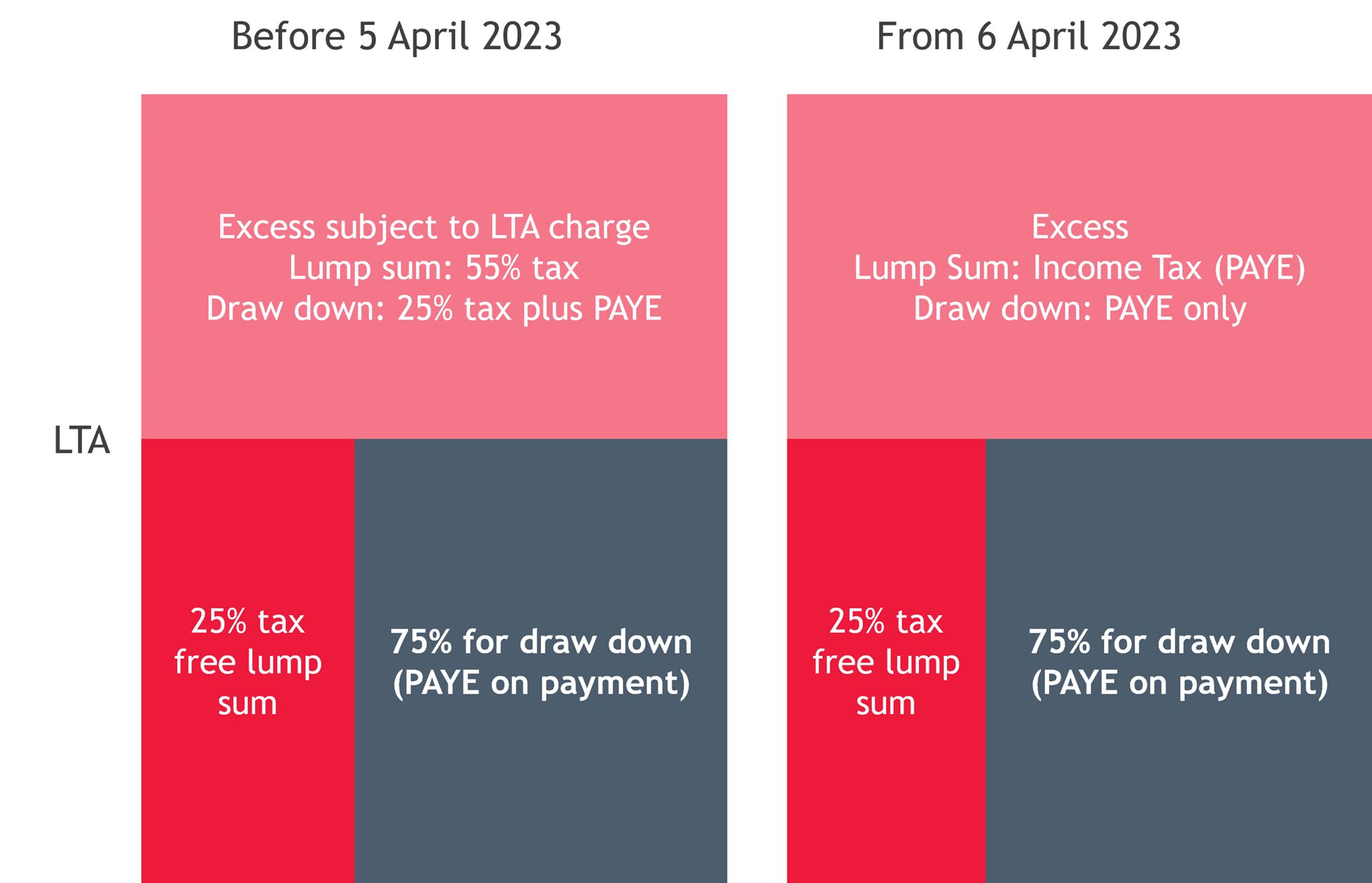

A person can extract 25% of their pension fund tax free, up to their LTA (retained for this purpose only). The remaining 75% can be set for drawdown or used to acquire an annuity, in either case the amounts received will be subject to PAYE.

For most people, the LTA is currently £1,073,100, but where an individual has previously obtained one of the historically available ‘protections’ they will be entitled to a higher LTA.

Where a person’s pension pot exceeds the LTA, they are able to choose whether to take it wholly as a lump sum or set for drawn down/annuity (or any combination of both). Before the abolition of the LTA on 6 April 2023 a 55% LTA charge was applied to a lump sum and a 25% LTA charge on crystallised to monies retained by the fund (with PAYE then being applied on the subsequent pension payments). Since 6 April 2023 no LTA charge is applied, instead, all benefits received by the member in respect of the excess is subject to PAYE.

In addition, from 6 April 2023 the abolition of the LTA means that no LTA charge will now arise on ‘benefit crystallising events’ that do not involve a withdrawal of funds, for example, death before age 75, 75th birthday and transfer to a QROPS. Consequently, tax becomes less of a hurdle where pensions are inherited.

Pensions and inheritance tax

Any succession planning for an individual should always consider pensions. Defined benefit schemes usually end on the death of the member and their spouse, but providing a defined contribution scheme has not been wholly used to acquire an annuity, then any undrawn amounts remaining on a person’s death usually passes to their beneficiaries.

Technically, the pension fund can be taken by the beneficiary either as a lump sum or left for income draw down in due course. However, the terms of many schemes solely allow a lump sum.

Currently, there is a general inheritance tax (IHT) exemption for pension funds, including most overseas pensions funds, so leaving excess pension pots to the next generation can be sensible planning.

However, two matters must always be borne in mind.

- Following the Parry Case (AKA ‘Staveley’) a deliberate decision to not draw a pension so that it will be inherited can lead to the denial of the IHT exemption for the pension; and

- If the deceased is over 75 when they die, any lump sum taken by the beneficiary will be subject to PAYE, which for large pension pots can mean that they are taxed at the additional 45% income tax rate.

The potential advantages of being able to pass on pension funds include:

- Inherited funds that remain invested will continue to benefit from tax-free growth until the beneficiary withdraws them. The pot can even be returned to beneficiaries (which does not impinge on their ability to fund a pension) or left for future generations.

- This effective ‘IHT exemption’ should be considered by anyone who will be able to fund their retirement by other means. Of course, the tax savings will depend on the income levels of beneficiaries.

- If an individual has no dependants, it is possible to nominate a charity to receive any remaining pension funds tax-free on death.

How we can help

For help and advice on any pension tax or inheritance tax issue please talk to us.