New rules for selling to UK customers after Brexit

New rules for selling to UK customers after Brexit

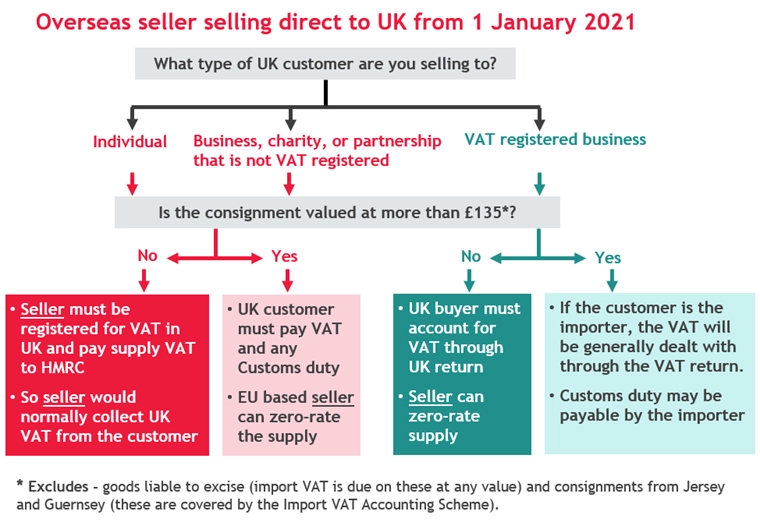

Overseas businesses selling goods directly to UK consumers and UK businesses that are not VAT registered must apply new VAT and Customs Duty rules from 1 January 2021.

Brexit changes

The United Kingdom’s departure from the European Union has resulted in a number of new VAT rules being put in place from 1 January 2021. These particularly affect the sale of low value goods to UK consumers (private persons and non-VAT registered businesses) and VAT registered UK customers, from outside the UK.

There are additional new rules for:

- Sales of low value goods (consignments valued at under £135*) that have been imported into the UK to sell on to consumers, businesses and via marketplaces

- Sales of low value goods located outside the UK and sold through marketplaces and platforms

- Imports and sales of low value goods to Northern Ireland consumers.

* Excludes goods liable to excise (import VAT is due on these at any value), and consignments from Jersey and Guernsey (these are covered by the Import VAT Accounting Scheme).

Who is impacted by the new rules?

All sellers (individuals, partnerships, companies and charities) based outside the UK and sending goods to consumers in the UK will be affected (no matter where the seller is located in the world).

Sellers from EU countries will see the biggest changes, as the EU VAT distance selling rules no longer apply to sales to UK customers, and for consignments over £135, the customer may have to pay VAT and Customs duty in addition, although the sale from the EU will be VAT-free. Sellers from outside the EU will also see changes for sales to UK customers.

What were the rules before 1 January 2021?

Before 1 January, the UK did not apply import VAT or customs duty on imports to consumers or businesses of a value under £15 (‘Low Value Consignment Relief’). No import VAT applied at all for EU to GB movements, and VAT was applied either at the seller’s VAT rate or under UK rates if ‘distance selling’ thresholds were breached.

For goods from outside the EU valued between £15 and £135, VAT was due on the import, and in almost all cases, the customer or business importing the goods was required by the delivery company or post office to pay the VAT before the goods were delivered or collected. Goods over £135 imported from outside the EU were subject to VAT and possibly customs duty.

What are the main changes from 1 January 2021?

The main changes are:

- Removal of low import VAT relief – the rules apply now to goods of any value, even under £15 consignment value.

- For sales to consumers of consignments of goods that are under £135, there is no import VAT due, but instead there is a requirement for the seller to declare supply VAT. This means that the seller must be VAT registered in the UK and pay the VAT due on such sales to the UK VAT authorities, HM Revenue & Customs (HMRC). The seller will need to collect this VAT from the customer, or else the VAT will be deemed to be included in the price paid.

- For sales to UK VAT registered businesses of consignments of goods that are under £135, the VAT due must be paid by the customer through its UK VAT return (ie the seller is not require to collect VAT from the customer or pay VAT to HMRC).

- For sales over £135 to UK consumers, a non-UK seller (including EU sellers) would be able to zero-rate the export sale, but the consumer will have to pay import VAT and possibly customs duty. The duty bill will depend on whether the goods are tariff-free under the EU/UK trade agreement or other arrangements the UK has with countries outside the EU.

What action should sellers based outside the UK take?

- Identify the VAT status of your buyer for low value goods – this may require additional processes at ordering, and potentially linking to the UK register of VAT registered persons to verify. You may also wish to review the ‘customer experience’ so that any VAT or duty cost to your customers is clear. This will also apply to goods over £135.

- The seller will still be required to send the goods to the UK with a customs declaration as normal and may do this itself or by using a courier or other agent. This applies to goods of any value sent to the UK.

- If sales of any low value goods are made to UK consumers, you will need to register for VAT in the UK (if you aren’t already – HMRC will charge penalties if this is not done).

- As a VAT registered business in the UK, the seller will need to comply with UK VAT rules including filing returns, paying tax and keeping digital records. However, as a VAT registered business, the seller will be able to reclaim VAT that is incurred in the UK, subject to holding proper invoices. Each 3 months the seller files a VAT return and pays to HMRC the VAT on sales (to consumers and non-VAT registered businesses) made, less the VAT on purchases bought in. Sellers based outside the UK can manage the process remotely or can appoint a local agent, for example BDO UK LLP.

I don’t want my customers to have to pay couriers etc separately, is there anything I can do?

Yes. If a seller brings goods valued at more than £135 into the UK in its name, it would be able to import without paying the import VAT directly, through a separate process called ‘postponed VAT accounting’. Then an invoice could be sent to the customer including UK VAT, but the goods could be delivered straight to the customer by the import agent, so it’s a smoother process for the customer. Goods under £135 are dealt with as noted above. However, the issue with this approach for goods over £135 is that an import agent will need to be appointed on an indirect (joint and several liability) basis.

Can anyone help me in the UK to comply with these rules?

Yes. BDO UK LLP can help you to consider the best approach for your business and how it operates. If you need to register for VAT in the UK, we can help and help you file VAT returns and advise on maintaining records. Unlike some countries, in the UK in most cases you are not required to appoint a VAT representative (someone who has joint and several liability with you) to deal with VAT registration.

Please get in touch with our team for specific help on your needs.