BDO’s Private Capital Survey and our global PE expert network cast light on the trends that define 2023 and beyond for PE firms and their portfolio companies.

The BDO 2023 Private Capital Survey, produced by BDO USA, encompasses insights from over 650 U.S. PE stakeholders. The survey includes private equity fund managers, portfolio company CFOs, and board members. Its findings highlight trends, opportunities and challenges defining the market landscape for PE firms and portfolio companies.

Expert insights from BDO private equity professionals around the world add a panoramic view to the survey’s findings, taking the global pulse of private equity and pivotal trends.

Top challenges for PE funds

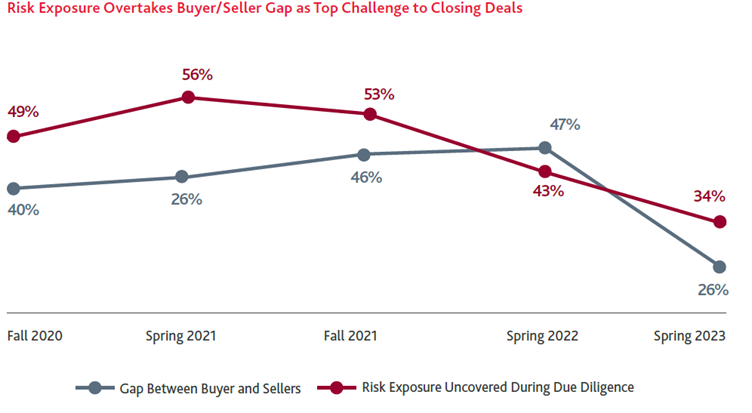

Q1 2023 was the slowest quarter for PE M&A activity since 2020. The fact underscores that economic developments, such as increased cost of capital and persistent inflation, continue to impact PEs and their capital deployment.

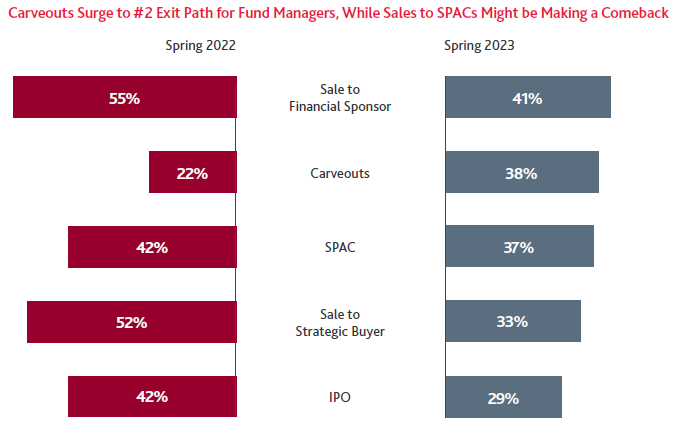

Source: BDO 2023 Private Capital Survey

The challenges PE fund managers and operating partners identified include risk exposure, lack of bandwidth, market consolidation, buyer and seller valuation gaps, increased competition, lack of quality deals, supply chain disruption, economic uncertainty, and lack of internal resources.