QAHC or Securitisation SPV - which is best for your next debt fund?

QAHC or Securitisation SPV - which is best for your next debt fund?

Choosing the right structure for your fund can make a significant difference to the flexibility you have to manage the investments, the level of administration required and your eventual returns. Until recently, a Securitisation SPV was the main choice in the UK for debt fund structures, but the new Qualifying Asset Holding Company (QAHC) regime now offers an attractive alternative. Legislation has now been introduced in the Spring Finance Bill 2023 to make clear that a securitisation company cannot be a QAHC so fund managers will have a straight choice between the two regimes.

In this article we investigate the pros and cons of both structures for PE houses looking to raise a debt fund.

Structure

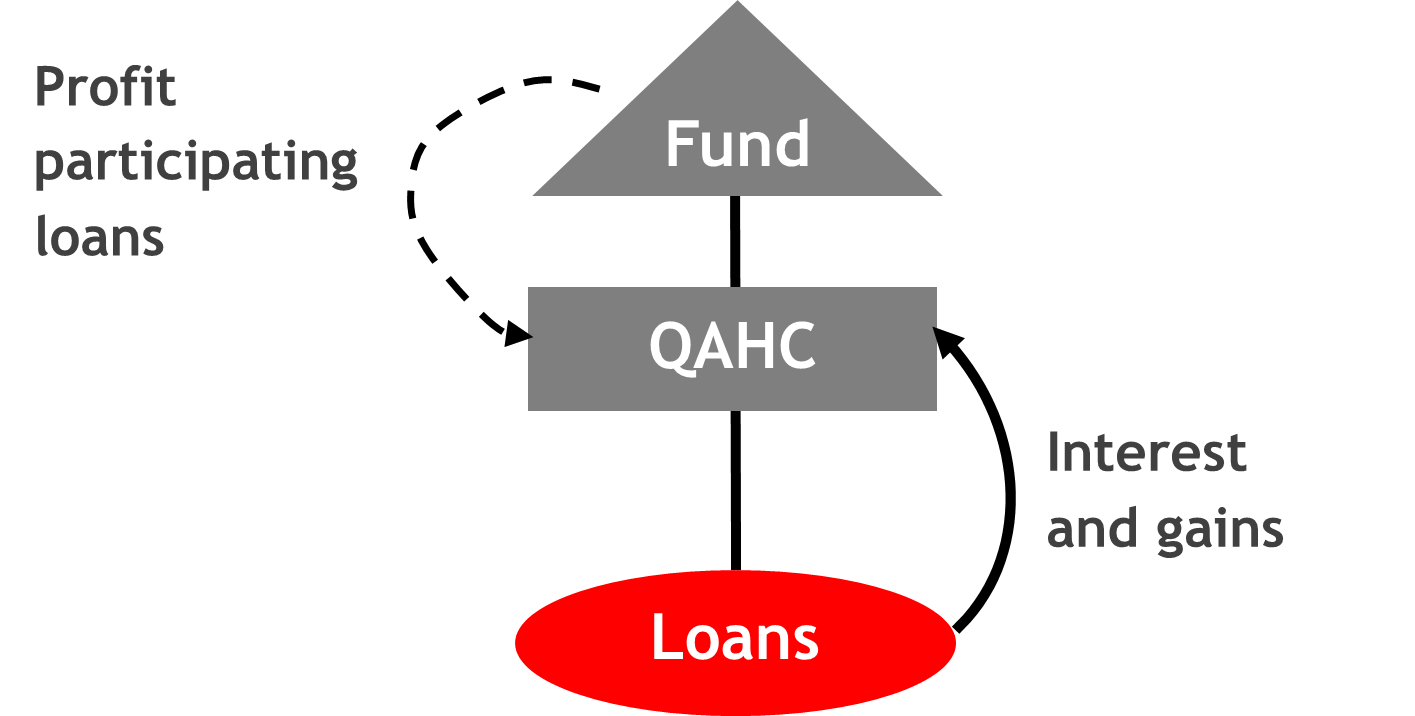

A typical QAHC structure (below) will be simpler than those fund managers will be used to with Securitisation SPVs. This means it is likely to be cheaper to implement and it may also have advantages from a regulatory perspective (depending on the precise structures).

Eligibility

There are a number of eligibility complexities with QAHCs and fund managers will have more experience of meeting the conditions of Securitisation SPVs set out below:

|

QAHC |

Securitisation SPV |

|---|---|

|

A company must:

|

A company will automatically fall within the ‘securitisation’ rules where it is either:

The company is also required to have a retained profit (normally a notional amount, for example £2k) but other profits must be paid out (the payment condition): broadly, the company must pay out all its cash receipts within 18 months of the end of the accounting period of receipt.

|

Taxing income

All QAHCs are subject to transfer pricing rules irrespective of size. Sensible use of profit participating loans (PPLs) should enable taxable income in the QAHC to reflect the small margin relevant to the limited activities undertaken by the QAHC. PPLs reduce the risks assumed by the QAHC and, therefore, the commensurate return. HMRC guidance supports that where activities of the QAHC are relatively simple and limited risk is assumed, the QAHC would be expected to retain no more than a marginal return.

By contrast, the special securitisation tax regime rules apply instead of normal corporation tax principles to provide that a Securitisation SPV’s taxable income is equal to the retained profit, a notional amount. ‘Pull to par' gains should not be taxed.

Therefore, with care, both regimes should give rise to minimal tax on income and pull to par gains. Equally, neither should create concerns over the tax treatment of interest paid or received. However, where the hybrid entity rules are in point (for example, if the entity is checked-open for US purposes), the hybrid mismatch rules may apply under the QAHC regime.

Other issues

QAHCs are able to hold a wider range of assets than Securitisation SPVs including shares and warrants and HMRC’s guidance on loan origination by QAHCs has been helpful in enhancing the attractiveness of QAHCs as a vehicle for holding debt instruments.

A Securitisation SPV requires listing of loan notes to manage UK withholding tax which creates additional cost when compared to a QAHC. And for source country WHT, the treatment of a Securitisation SPV is potentially a disadvantage with respect to cross-border loans.

If there is an intention to dispose of loans then the QAHC may be a more flexible vehicle but a Securitisation SPV has a stamp duty advantage with respect to the transfers of the PPL, even if such transfers may be rare.

Conclusion

As QAHCs were created by the government to make it more attractive to operate funds in the UK it is perhaps no surprise that overall they offer more attractions and flexibility than a fund falling within the securitisation tax regime. Yet there will be many circumstances where a QAHC is not viable, possible or optimal and Securitisation SPVs will remain a useful alternative in such circumstances.

For help and advice on choosing the right structure for your next fund, please contact James Boyd, Jennifer Wall or James Pratt.