Corporate transactions remain as complex as ever, so it’s important to seek sector-focused expert advice.

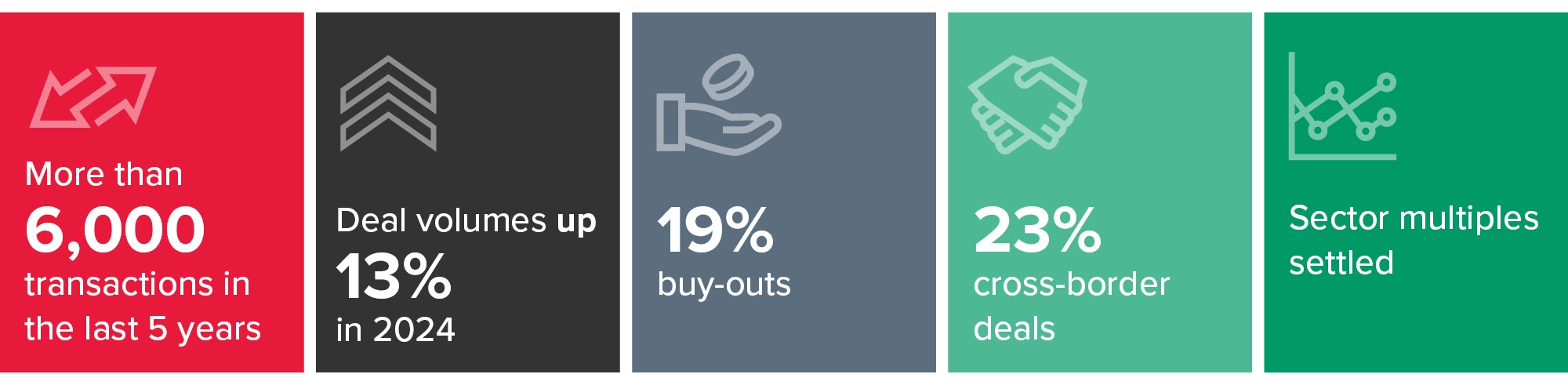

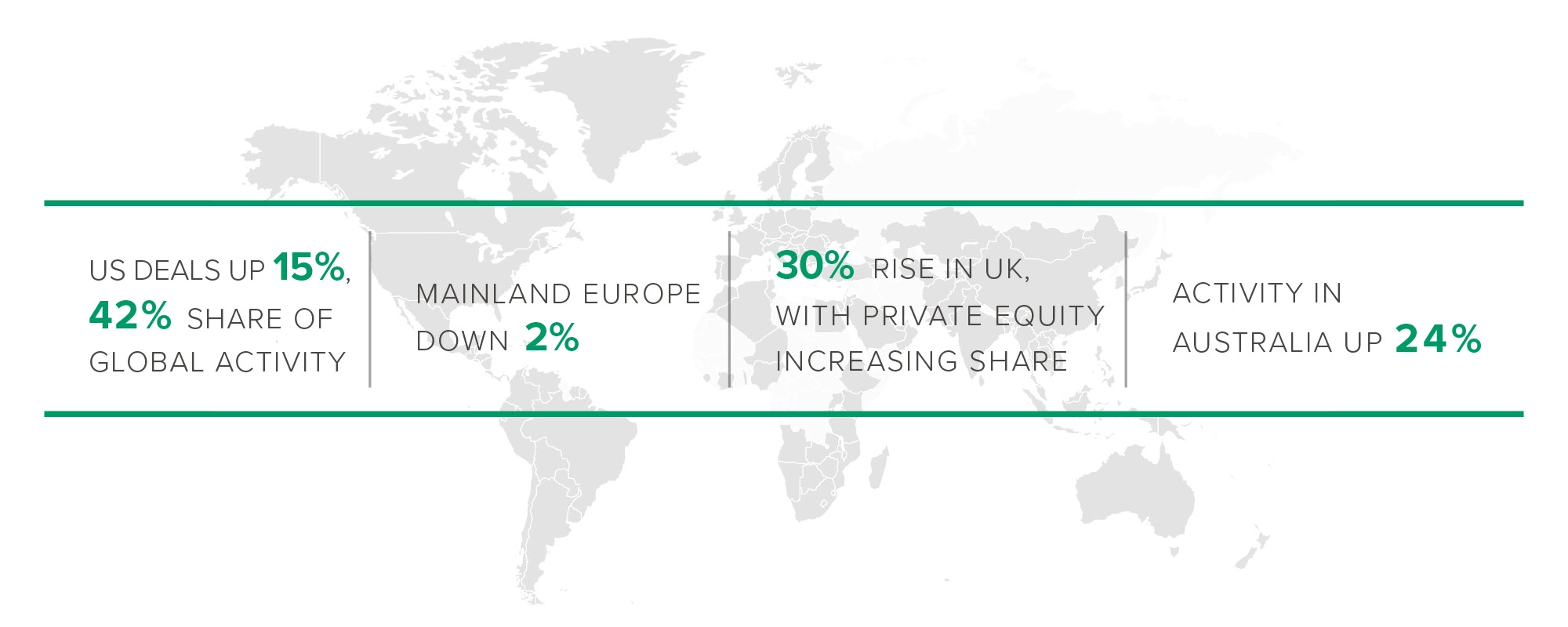

Our global Building Products & Services M&A team is one of the most active advisory houses in the sector, with more than 1,000 sector deals completed in the last five years. We work closely with leading midmarket, privately-owned businesses, corporates and private equity firms. We understand company strategy, market and commercial drivers, and have advised businesses at all stages of the investment lifecycle.

If you’re thinking of embarking on M&A or would like to discuss any of the issues driving change and value in the market, we would be delighted to talk to you.