Tax considerations from the introduction of IFRS 9

Tax considerations from the introduction of IFRS 9

IFRS 9 – Financial Instruments was introduced by the IASB in response to the global financial crisis and is effective from 1 January 2018, replacing the existing standard IAS 39. The key accounting impacts of IFRS 9 that are envisaged to give rise to transitional adjustments are:

- Classification and measurement – more financial assets are likely to be measured at fair value

- Impairment – using the Expected Credit Loss (ECL) model, impairment provisions are likely to be larger and recognised earlier.

While IFRS 9 will have the greatest impact on companies in the financial sector, the majority of corporates will also be affected as they will typically hold some financial instruments such as loan or trade receivables. In addition to IFRS reporters, companies that prepare financial statements under FRS 102 (that have chosen to adopt the principles in IFRS 9) or FRS 101 will be affected. Those companies will need to consider the tax impact of any transitional adjustments arising from the application of IFRS 9, particularly in relation to impairments of loan relationships.

Transitional adjustments

The transitional adjustments could arise where, for example:

- An impairment provision is recognised in respect of a loan receivable using the ECL model which differs from the impairment provision previously recognised

- An instrument which has previously been measured on an amortised cost basis is now required to be measured on a fair value basis for the first time and there is a difference between the carrying value at the end of the last period under the old basis and the start of the first period under the new basis

- An instrument which has previously been measured at fair value with fair value movements recognised in other comprehensive income (OCI), e.g. a bond classified as Available for Sale, is now measured at fair value through profit or loss with amounts previously recognised in OCI being reversed and amounts now reflected in the profit or loss.

Tax rules for transitional adjustments

There are special tax rules to deal with the treatment of one-off transitional adjustments on financial instruments which fall within either the ‘loan relationship’ or ‘derivative contract’ rules on transition from one basis of accounting to another. Entities should seek tax advice to determine which financial instruments fall within the ‘loan relationship’ and ‘derivative contracts’ transitional rules. However, this will typically include loan receivables and debt securities.

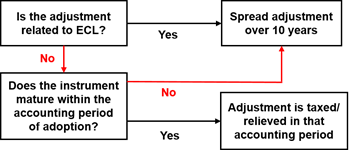

In most cases, the debit or credit concerned is spread over ten years, i.e. the entity will take 10% of the transition adjustment into account starting from the year that the adjustment occurs. However, if the instrument concerned matures in the accounting period in which the new basis is adopted, the adjustment will need to be taxed or relieved in full in that accounting period, provided the adjustment does not relate to an impairment using the ECL model as such adjustments will always be subject to a 10 year spread.

These special tax rules are summarised in the diagram below:

Entities should be aware that the tax adjustments arising upon initial application of IFRS 9 will be in addition to, and could interact with, other ‘spreading’ tax adjustments due to recent changes in tax legislation (eg reversing amounts previously recognised in OCI and brought into account for tax) and accounting standards (eg adoption of FRS 102).

Subsequently, the tax treatment will follow the IFRS 9 accounting treatment, eg movements in ECL or fair value that are recognised in P&L will be relieved/taxable in the period in which they arise.

Conclusion

The tax impact of the transitional adjustments will depend on the exact nature of the adjustment and the type of financial instrument affected (eg equity, derivative, loan or trade receivable) and are likely to have both a current tax and deferred tax impact.

Companies should start to consider the tax impact of these adjustments on their tax profile for the period.

For help and advice on IFRS 9 please get in touch with your usual BDO contact or Dan Taylor.

Read more on IFRS 9