How CFOs are leading data-driven decision making

How CFOs are leading data-driven decision making

In the era of AI and advanced analytics, data is no longer just a financial asset, it’s a strategic driver. For Chief Financial Officers (CFOs) increasingly stepping into the role of Chief Value Officers (CVOs), data-driven decision making is central to success.

With regulators, investors and stakeholders demanding greater transparency and value reporting beyond the balance sheet, here’s how modern CFOs are placing data at the heart of their decision making.

From CFO to Chief Value OfficerDiscover how finance leaders worldwide are evolving their roles to drive broader business value. This in-depth report from BDO and the ACCA features insights from nearly 100 finance leaders and explores the skills, challenges and data-driven strategies shaping the future of the finance function. |

Why data is reshaping finance leadership

Data has always been central to the finance function, but in today’s AI-enabled world, it has also become key to long-term organisational strategy. As finance leaders move beyond traditional reporting, they are being called upon to integrate a broader set of metrics into real-time decision making, harnessing the intuitive models at the heart of financial planning and analysis (FP&A).

Our research with the ACCA shows that CFOs are increasingly using advanced analytics to drive decisions across areas traditionally outside the finance remit, including customer experience, supply chain, talent and sustainability. These are now core to long-term value creation.

This evolution calls for more than just tools. CFOs must build finance functions capable of translating complex data into insight, integrating predictive models and supporting smarter decisions at every level.

“We’re moving into an era where data is driving real operational improvements. But there’s still work to do, particularly in bridging the gap between data teams and the business. A big part of the challenge is helping people understand what’s possible when data is harnessed effectively.”

Andy Griffiths, CFO, Bristol Airport

Read more: Bristol Airport CFO, Andy Griffiths on leadership, data and talent

A broader definition of value requires more data

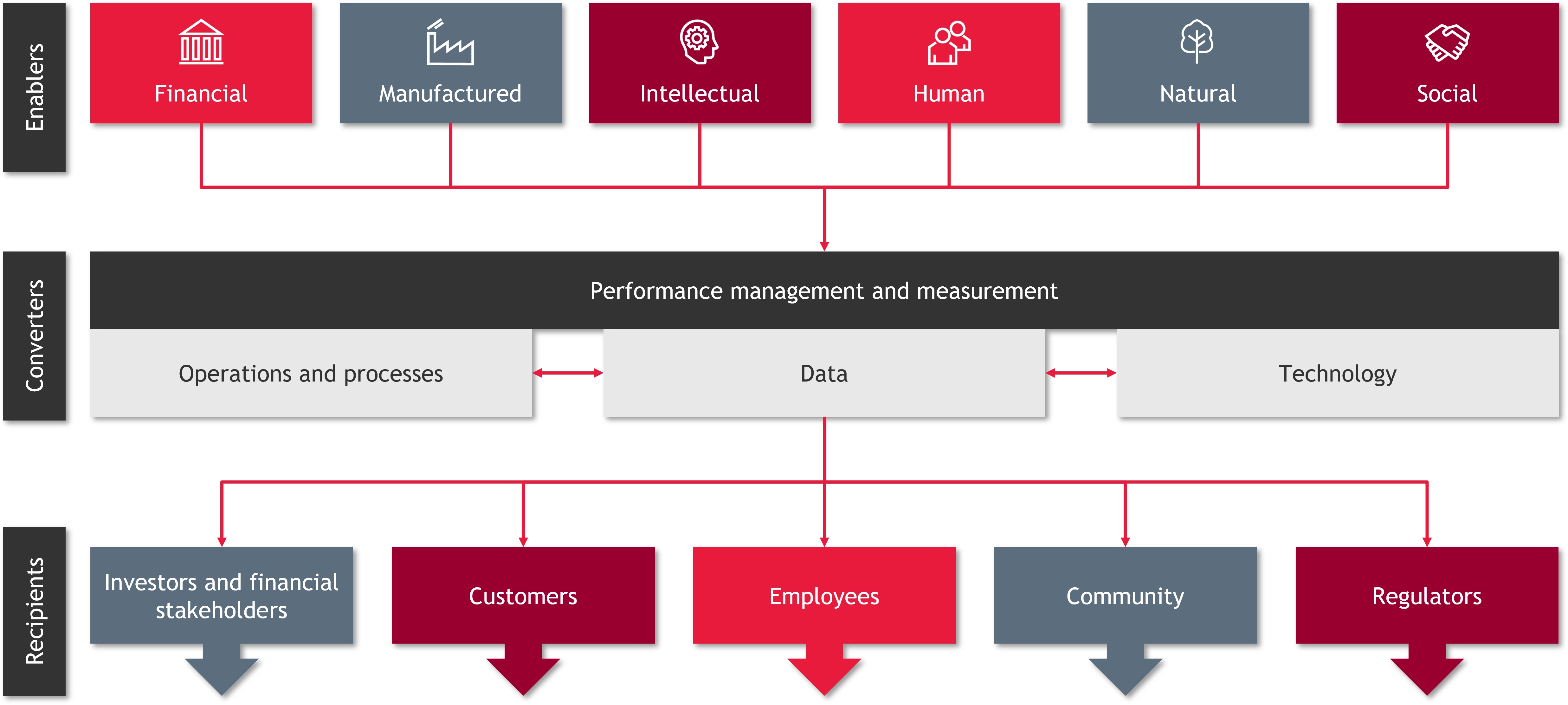

The IIRC's Integrated Reporting Framework outlines how corporate value is increasingly being seen in non-financial terms. It identifies six enablers of value: financial, manufactured, intellectual, human, natural and social and relationship capital.

Each of these enablers has its own data points, metrics and reporting standards, which finance leaders are having to grapple with while juggling the expectations of the CEO and investors/PE houses. Tracking trends across multiple sources of value is a herculean task and CFOs and CVOs will only succeed with the aid of data and technology.

Whilst there is a continual requirement for more data points from more sources, this is at its most useful to a business and the CVO if these data points can be efficiently coalesced and transformed, overlaid easily and visualised in a quick and accurate manner.

Enabling data-driven decision making

Financial reporting is essentially a looking-back process, reviewing performance of a business after the event. In contrast, today’s finance leaders are being tasked with producing forecasts and proactively shaping decision making. This requires a much greater reliance on real-time and predictive data, which is where tools such as AI will come in.

“We have dedicated teams looking at future transformation opportunities. For example, we have a nascent AI hub exploring use cases in finance, and we’ve centralised expertise in certain technologies like Python to replace Excel.

“Beyond that, there’s a huge amount we could do over the next five years, like using AI to support code development. There’s also a lot of potential in our contracting processes.”

Mark Godson, Group CFO, Just Group

Read more: How AI and Automation are shaping the Group CFO role at Just Group

Let’s take a look at some of the core technology enablers being leveraged for success:

Accounting and ERP Platforms

Rapidly and accurately perform basic data handling tasks, allowing CFOs and their teams to focus on value-added tasks. The consideration and specification of the right accounting platform and app stack is key to implementation success.

Analytics Systems and Dashboards

Pull data from diverse sources and display them in a way that delivers instant, actionable and intuitive insights without the need for time-consuming and potentially error-prone manual data manipulations. These systems enable users to slice information and interrogate the data much more easily than traditional reporting packs, which is especially useful as a scalable solution.

Forecasting and Modelling Systems

Use historic data to extrapolate trends and provide early warning of business risks and opportunities, taking into account external data which may, for example, influence buyer behaviour and/or supply chain logistics. Such forecasting and modelling operates on an objective basis, mitigating and challenging the impact of unconscious bias in forecasting and potentially identifying trends or dynamics that may not previously have been known.

Read more: How does the need for broader reporting impact CFOs?

The path to data-driven leadership

The shift to value-based, data-led decision making is already underway, but it requires more than just investment in platforms. It demands the right skills, structures and strategic mindset.

While some businesses may have in-house capabilities, many will need to draw on external specialists. Knowing when to seek the right IT and analytics support will be critical to the successful evolution of the CFO into a true Chief Value Officer.

Ultimately, the future of financial leadership lies in mastering data-driven business decisions. CFOs must become fluent in the platforms and processes that enable real-time insights and long-term strategic value. As the role continues to expand, using data to make decisions isn’t optional, it’s the defining skill of modern finance leadership.

Ready to transform your finance function?

We help CFOs harness data, technology and insight to lead transformation and be more agile in their decision making.

Partner with BDO to future-proof your finance function and accelerate your journey to becoming a data-driven finance leader.

Chief Value Officer: The Important Evolution of the CFO copyright © 2023 by the Association of Chartered Certified Accountants (ACCA). All rights reserved. Used with permission of ACCA. Contact insights@accaglobal.com for permission to reproduce, store or transmit, or to make other similar uses of this document.