Welcome to our second article in our series of thematic publications focusing on the Investment Firms Prudential Regime (IFPR). In this article, marking the one-year anniversary of the IFPR going live, we share our views on the new remuneration code brought about by the new regime and provide insights into the key considerations firms need to have in implementing the new code.

Get a better understanding of key aspects of IFPR implementation, focusing on the following themes: ICARA, Remuneration, IFPR Implementation, Wind down planning and Public Disclosures.

What has changed?

The Investment Firms Prudential Regime (IFPR) represents a significant change in the prudential rules and requirements applicable to investment firms with MIFID permissions (‘MIFIDPRU Investment firms’ such as asset and wealth managers, commodity and other securities brokerages). The new requirements are enshrined mainly in the MIFIDPRU Sourcebook (“MIFIDPRU”), which forms a new chapter in the Financial Conduct Authority’s (“FCA”) Handbook, as well as in other sections of the Handbook covering governance, systems and controls and reporting requirements.

As a result, previous exempt-CAD, BIPRU and IFPRU firms have, over the past 12 - 24 months, had to implement operational changes to establish the systems and controls needed to ensure compliance with these new requirements.

One of the areas in which IFPR establishes new requirements is remuneration policies and practices. The FCA have introduced a new MIFIDPRU Remuneration Code (the “Code”), which will apply to performance periods beginning after 1 January 2022.

It should be noted that the Code presents more of an evolution than a revolution of the remuneration rules. So, whilst it is true that it is ‘out with the old BIPRU and IFPRU remuneration codes and in with the new’, firms previously complying with the now repealed BIPRU and IFPRU codes, will likely find many familiar provisions in the Code.

For those firms, such as the previously exempt-CAD firms, that had no specific remuneration rules to comply with prior to the implementation of IFPR, the Code represents a step-change in regulatory requirements.

Why were Remuneration Codes introduced?

Before diving into the detailed requirements of the Code, it is worth disembarking briefly to consider why Remuneration codes were introduced in the first place.

History is littered with examples of individuals and groups of individuals not acting in the best interest of their clients or posing a threat to the integrity of the markets while seeking to optimise financial rewards for themselves.

Remuneration codes have sought to reduce the risk of inappropriate incentivisation by better aligning reward structures with risk taking and supporting the regulator’s objectives of consumer protection and market integrity. Predominantly, alignment is sought through designing variable remuneration schemes in such manner as to be aligned with the long-term interests of the firm and its clients. The codes did this by requiring firms to consider safeguards such as malus and clawback, deferrals, retentions and payments in shares or other share-linked instruments in the award of variable remuneration.

Who is in scope of the new rules?

The Code applies to all MIFIDPRU investment firms, which, amongst others, includes Collective Portfolio Management Investment firms (CPMIs). CPMIs are subject to the AIFM and/or UCITS remuneration codes which means that these firms would be in scope of multiple remuneration codes. Where multiple codes apply, and a conflict exists, the FCA requires firms to comply with the more stringent provision, though this is expected to be rare in practice given the similarity in the nature of the provisions.

Overview of the MIFIDPRU Remuneration Code

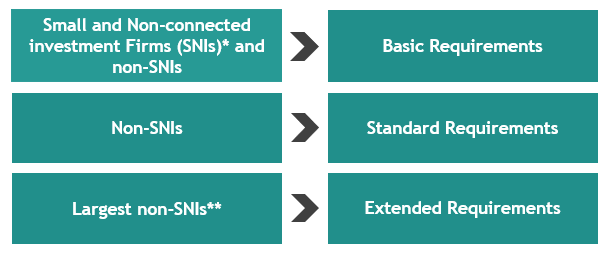

A key feature of the Code is the ‘baked in’ proportionality principle with a tiered application of remuneration provisions as shown in the image below. The requirements are incremental in nature such that all non-SNIs are in scope of the basic requirements and the standard requirements whilst the largest non-SNIs are in scope of all three requirements.

*SNIs are firms meeting the characteristics as set out in MIFIDPRU 1.2.1 which include having average AUM of less than £1.2billion, not holding client money or safeguarding and administering client assets, not having permission to deal on own account, having on-and off-balance sheet assets of less than £100m, having total annual gross revenues of less than £30m.

** These are firms with the following characteristics: the value of their on-balance sheet assets and off-balance sheet items over the preceding 4‑year period is a rolling average of more than £300m, or the exposure value of their on-balance sheet assets and off-balance sheet items over the preceding 4‑year period is a rolling average of more than £100m (but less than £300m), and the exposure value of their trading book business is greater than £150m, and/or derivatives business is greater than £100m.