UK altnets: recent trends

UK altnets: recent trends

In recent months, a number of UK altnets (alternative network providers), including Cityfibre, Grain and Wessex for example, have secured new growth capital from debt and equity investors in the face of a highly challenging funding environment. Whilst this might offer a beacon of hope for growth of the sector, there remains a long way to go.

In 2025, over 100 altnets, serving over 16.4mn homes according to the Independent Networks Cooperative Association, have received more than £17.4bn of investment since 2020 - an average cost of £1,061 per premises passed. This has risen significantly from an estimated £397 per premises passed in 2022, rising to £671 in 2023.

In the past few years, however, investors and the Government have raised concerns regarding the longer-term profitability of altnets, having been squeezed by a rise in interest rates, a dramatic increase in costs and in turn, a failure to deliver on business plans, first in terms of pace of rollout and latterly in terms of connections.

Altnets collectively lost more than £1.3bn in 2023, according to Enders, driven partly by slower-than-forecast take-up rates and lower ARPUs (Average Revenues Per User). The result? A substantial tightening of purse strings, notably by credit committees.

What’s next for altnets?

Altnets are exiting the growth phase and entering a ‘shakeout’ phase. Inefficient or weaker operators incapable of transitioning business models from “build, build, build” to “sell, sell, sell”, or that are subscale are unable to attract the capital they need to fund them through to profitability, will begin to exit the market, consolidate, or get acquired. Larger networks are attractive to national wholesale customers, with wholesale partnerships allowing an altnet to build penetration more quickly - albeit at the expense of ARPU. Nevertheless, many altnets are continuing to forecast their future under a retail-dominated model.

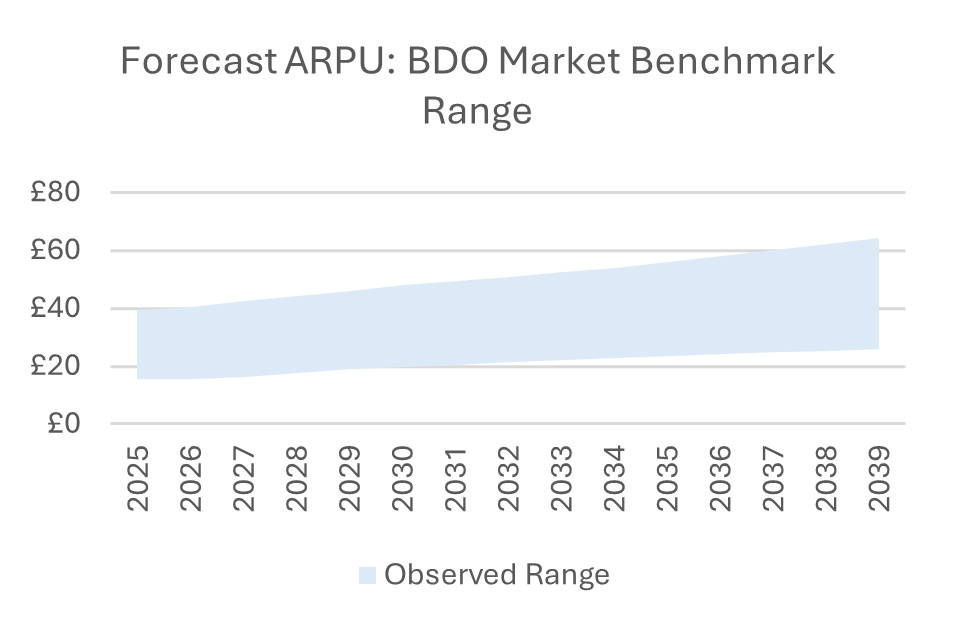

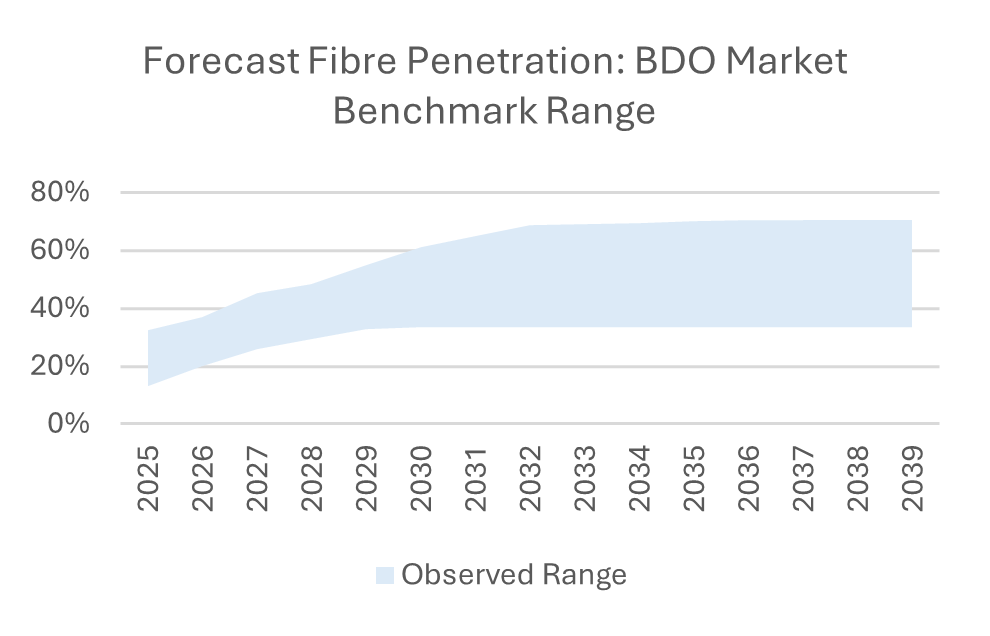

This is reflected in the large range of ARPU forecasts and penetration expectations that we are seeing in the market:

Altnets with wholesale partnerships are, in general, expecting to build penetration far more quickly, especially where their geographic coverage makes the last mile connection more straightforward. Altnets with a retail focus are, in general, forecasting a sizeable ARPU, and where they are not overbuilt are expecting to exploit that exclusivity to grow ARPU at above inflationary rates.

According to Neos Networks, 96% of altnets are exploring M&A and partnerships. This may be due to a range of factors, namely:

- Decreasing ability to maintain growth purely through greenfield broadband expansion in increasingly competitive regions

- Investors stressing the need to demonstrate achievement of performance metrics (such as subscriber penetration, revenue generation, and sustainable ARPU) to justify further injections of capital.

Altnet consolidation

FullFibre and Zzoomm merged in early 2025, combining their strengths in FTTP (Fibre to the Premises) networks. In 2024, Netomnia and Brsk joined forces to become the third-largest altnet in the UK, with a reach of 1.5 million homes. CityFibre expanded its market presence by acquiring Lit Fibre. Additionally, Macquarie Capital and other investors acquired Broadway Partners, Voneus, SWS Broadband, and Cadence Networks, forming a new combined entity which will see “up to” £250m (€288m) injected into the combined group in new capital.

This ‘shakeout’ could mean that ultimately, the 100 plus altnets that currently exist in the market may be whittled down to less than a dozen. Large altnets will overtake highly regionalised providers and expand out into other areas, offering an avenue for stronger operators to grow, and for smaller players to secure funding or exit.

Forward-Looking Considerations for Valuation

Despite ongoing pressures, sector analysts expect the broader UK FTTP market to maintain a positive trajectory, with full-fibre coverage potentially nearing nationwide levels by the latter part of the decade. This creates a generally supportive environment for network operators other than BT Openreach and Virgin Media O2 (VMO2) to demonstrate sustainable penetration and ARPU.

From a valuation standpoint, future altnet performance will likely hinge on a combination of factors:

- Penetration and churn management: Achieving and maintaining satisfactory penetration rates underpins positive cash flow forecasts. Operators with effective churn mitigation strategies and strong subscriber retention may achieve higher valuations.

- Diversified revenue streams: As competition intensifies, many altnets are exploring enterprise-grade solutions, managed services, and partnerships with content providers. These endeavours can create more resilient revenue models.

- Consolidation and strategic alliances: Ongoing M&A activity is expected to shape the structure of the market for the remainder of the decade. Operators with stronger financial metrics may continue to attract funding or acquire smaller networks, building economies of scale.

- Capital efficiency: With funding now more conditional on performance, altnets scrutinising their Capex outlays and operating costs may achieve superior valuations, as a leaner cost base can improve margins.

- Management competency: A pre-revenue business in the construction phase is very different to a business with built-out infrastructure and in the early stages of growing a customer base. Having the right leadership and senior management to deliver a customer acquisition strategy is critical for driving value.

- Regulatory and policy developments: Regulatory decisions on network access, market competition, and infrastructure transitions can materially influence altnet business models. Robust engagement with policymakers and detailed scenario analysis around regulation can enhance investor confidence.

Where BDO can help

BDO has significant market insights through the breadth of its advisory and audit work. This uniquely positions BDO to assist both altnets, their investors and stakeholders in navigating the complexities of the UK FTTP market, recognising the importance of business model and factors such as capital efficiency, penetration levels, ARPU, and churn mitigation strategies. If you or a business you work with needs advice on any of the following, please get in touch with the team, who will be happy to help.

- Business Valuation Services: Independent valuations and financial insights that inform your strategic decisions, whether for growth, consolidation, capital stewardship, or investor reporting. Many transactions are structured as share-for-share deals, so an objective assessment of value of both parties should underpin the deal terms.

- Financial Modelling and Feasibility Studies: Developing and reviewing financial models that reflect projected cash flows, investment requirements and potential returns, given evolving market conditions.

- Sell-side Advisory: Expert support in preparing and navigating the sale of the businesses, including preparing marketing materials, identifying potential buyers, managing due diligence, and negotiating the deal through to completion.

- Transaction Support: Due diligence services and valuable insights to help you make the right business decisions when completing a deal.

- Restructuring: Expert guidance to navigate financial and operational difficulties or even insolvency, through our comprehensive turnaround and rescue services.

To find out more on this topic and for a conversation on how BDO can support you, please get in touch with Simon Jones.