CIR Lessons – CIR Lessons - Public infrastructure rules

CIR Lessons – CIR Lessons - Public infrastructure rules

See all our CIR Lessons articles.

The public infrastructure rules were included to ensure the CIR did not cause uncertainty for infrastructure or, somewhat generously, real estate investment. Some infrastructure investors immediately embraced these rules but there are cases where they can give a significant sting in the tail and leave the investor out of pocket for a number of years.

The broad principle of the rule echoes the group ratio, with a deduction secured for third party debt. However rather than the uncertainty of the group ratio, which must be tested each year and is capped at 100% of tax-EBITDA, the public infrastructure rules operate by entirely removing the affected interest from the CIR calculations.

Most other figures from an elected ‘Qualifying Infrastructure Company’ (QIC) are also excluded from the calculation, with no interest income or tax-EBITDA taken into account.

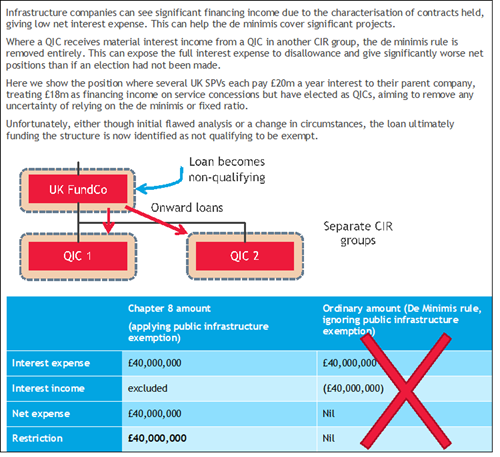

The direct implication of this is that if a group is only comprised of QICs, any interest not excluded (e.g. paid to a related party non-QIC) would be disallowed if not covered by the public infrastructure rules modified de minimis rule. This can potentially give a worse result than the fixed ratio.

As with the group ratio, it is important to ensure the third-party loans are truly exempt.For this, there is both a test on any share rights between the lender and the group, and ensuring the loan is not subject to security over any non-qualifying assets.

There are certain rules and several elections available to support the public infrastructure rules. In particular, third-party funding can flow via an overseas group member in certain cases without losing access to the exemption. Elections can join the treatment of multiple group members, ensuring consistent treatment and making tests for ‘insignificant’ non-qualifying activity easier to pass. All such elections and special rules need careful consideration and application.

It is reasonably common for infrastructure funds to hold investments in different projects at fair value, giving multiple CIR groups. Interest flowing up a structure can exacerbate disallowances if a loan ceases to qualify, for instance because a parent company ceases to qualify, due to the exclusion of interest income from calculations and the removal of the de minimis in certain cases for QICs.

Harmful election example

For help and advice on the CIR please get in touch with andrew.stewart@bdo.co.uk or your usual BDO contact.