Employee Ownership Trusts (EOT)

Employee Ownership Trusts (EOT)

2024 Budget changes to the EOT legislation

Key changes to the EOT legislation were announced in the Autumn 2024 Budget which will be enacted via the Finance Bill 2024, a draft of which was released on 7 November 2024. Most, but not all, of the changes will take effect from Budget day on 30 October 2024. For more details - find our full analysis of the employment tax changes on our Budget hub.

What’s new?

EOTs are not just an option for traditional companies. Limited Liability Partnerships and companies that are part of a bigger group can also adopt an employee ownership structure. It is possible to find commercial and innovative ways to transition almost any type of business to employee ownership structures.

As different types of business examine how employee ownership trusts can be used, we are expanding our knowledge and expertise in this area.

The combined impact of a very challenging M&A market, as a result of relatively high interest rates and low economic growth, and the anticipated rise in UK capital gains tax, has resulted in a substantial spike in the number of shareholders looking to sell their companies to Employee Ownership Trusts.

An employee ownership trust is a statutory trust enacted by the Government to encourage more companies to become EO (see below for more details).

UK resident shareholders are, subject to satisfying certain statutory conditions, able to sell shares in their company for a full commercial market value and claim a complete UK Capital Gain Tax exemption.

The total number of UK employee owned (EO) businesses towards the end of 2023 is c.1,400, a c.40% increase on 2022, with a total of 332 new EO business across 2023. This means that the EO sector is now the fastest growing SME business ownership model with, on average, one company becoming EO every single day.

Employees can receive (i) annual tax-free cash bonuses of up to £3,600 per employee per year and (ii) share-based incentive awards. Arguably one of the most important benefits of being an EO business is that employees have a stake in their company and the greater employee engagement and commitment that results from this.

Many companies have also found that moving to an EO model has been a “game changer” for their ability to attract and retain key talent.

Of those looking to sell, many opted to sell to employee ownership trusts rather than a standard trade sale for numerous reasons. These include: (i) allowing shareholders and the directors to conclude a quick and smooth transition of the company to the employees, via an employee ownership trust, thus allowing management to focus on running the business rather than becoming embroiled in complex and time consuming sale negotiations; (ii) allowing shareholders to receive full value for their business without the need for earn-outs (a proportion of earn-outs never pay out the extent expected by shareholders); (iii) utilising the power of employee-ownership to lock-in, engage and motivate the workforce to take the company to the next level; (iv) substantially lower transaction fees; and (v) allowing shareholders to claim a full UK capital gains tax exemption on the disposal.

The key sectors in which we are seeing a substantial movement towards employee-ownership, via employee ownership trusts, are tech and media, marketing, architecture, construction, logistics and recruitment sectors.

If you own a trading company, you can now sell some, or all, of your shares to an employee ownership trust (subject to satisfying certain conditions) for full market value without incurring any capital gains tax liability in a way which also benefits your employees.

What is an EOT?

An EOT is a special form of employee benefit trust introduced by the Government in September 2014 to encourage more shareholders to set up a corporate structure similar to the John Lewis model. The aim is to facilitate wider employee-ownership, albeit via an indirect holding.

The incentive for owners is that the Government introduced very generous tax breaks to encourage shareholders to move to an employee-ownership model. However, to qualify for the tax incentives, the employee ownership needs to be structured in a particular way.

Although the tax breaks are aimed at companies, there is no reason why those businesses that are held by a partnership couldn’t be incorporated so that, when the time comes for exit, the shareholders (former partners) can sell their shares to an EOT.

How does a sale to an EOT work?

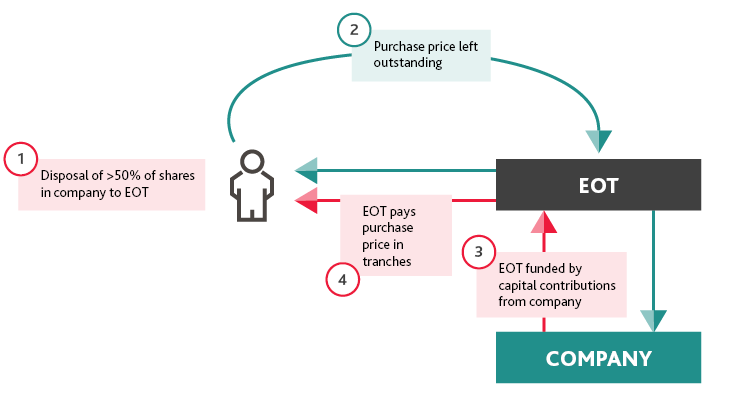

There are three key steps:

- A qualifying EOT will be established with a UK resident corporate as the trustee of the EOT (the Trustee Company).

- The shareholders sell their shares to the Trustee Company under a share purchase agreement. The shareholders and the Trustee Company will jointly engage a share valuation expert to value the company: the Trustee Company will use this value as the basis for determining the purchase price. On the sale of the shares, the purchase price will create a debt owed by the Trustee Company to the shareholders which will be left outstanding (see diagram).

- The company will continue to generate trading profits each year and it will use these profits to make contributions to the EOT. The EOT will use these contributions to repay the outstanding purchase price that it owes to the shareholders.

What are the advantages of selling to an EOT?

There are many advantages for shareholders, some of which we’ve highlighted below.

- It allows employees to indirectly buy the company from its shareholders without them having to use their own funds - thereby creating an immediate purchaser and addressing succession issues

- Shareholders can sell their shares for full market value (an independent valuation will be required). The draft Finance Bill 2024 has introduced a requirement that the Trustee Company must take all reasonable steps to secure that the consideration for the disposal does not exceed the market value of the ordinary share capital at the time of the disposal and where part of the consideration for the disposal is deferred, that the rate of any interest payable in relation to the deferred consideration does not exceed a reasonable commercial rate.

- No capital gains, income or inheritance tax liabilities should arise on the disposal of a controlling interest in a company to an EOT (or on the subsequent receipt of the purchase price by the former shareholders)

- Not all shareholders are required to sell their shares to the EOT

- The directors can remain in situ post-disposal and can continue to receive market-competitive remuneration packages

- The EOT is generally seen as a “friendlier purchaser” which means the sale process may be quicker, with potentially lower fees.

Click here to request our free practical guide on why you should now consider selling your business to an Employee Ownership Trust.

What are the advantages for the company and employees?

As all employees get an indirect stake in the company there are substantial practical benefits associated with being owned by an EOT, such as:

- Greater employee engagement and commitment

- Reduced absenteeism

- Greater drive for innovation

- Improved business performance.

Companies controlled by EOTs are also able to pay tax-free cash bonuses to their employees of up to £3,600 per employee per year.

Key qualifying conditions

To carry out a qualify sale to an EOT there are five key conditions to meet:

- The company whose shares are transferred must be a trading company or the principal company of a trading group

- The trustees of the EOT must restrict the application of any settled property (the shares) for the benefit of all eligible employees on the “same terms”

- At least 50% of EOT trustees (and persons “connected” to them) must not be “excluded participators”; and the company must not be under the “control” of excluded participators. Where a corporate trustee is used, the majority of the directors of that trustee must also not be “excluded participators”. Broadly, an “excluded participator” is a shareholder or former shareholder of the company but does not include someone who was not beneficially entitled to, or to rights entitling them to acquire 5% or more of, or of any class of the shares comprised in, the company’s share capital; and on a winding-up of the company would not be entitled to 5% or more of its assets.

- The trustees must be UK resident and retain, on an ongoing basis, at least a 51% controlling interest in the company

- The number of continuing shareholders (and any other 5% participators) who are directors or employees (and any persons connected with such employees or directors) must not exceed 40% of the total number of employees of the company or group

- Trust property must generally be applied for the benefit of all eligible employees on the same terms but the trustees may distinguish between employees based on remuneration, length of service and hours worked.

Your next steps

In just the last year, BDO has worked with numerous companies, as well as LLPs and groups, on establishing, or working towards establishing, employee ownership structures via Employee Ownership Trusts. They have ranged from companies with just 20 employees to over 1,800, with values from £1m to over £750m and from all sectors (including construction, architecture, recruitment, media, technology, marketing, professional services, transportation, corporate finance and manufacturing). We are helping shareholders sell their businesses while navigating the many pitfalls which can catch-out the unwary. Please let us know if we can help you.

Our team is the market leader in advising on EOT and employee-ownership and can provide you with free, practical and user-friendly advice on the advantages and disadvantages of selling your business to an EOT.

For help and advice on selling your business to an Employee Ownership Trust please contact Matthew Emms.

Client Testimonials

- “Simply 10 out of 10 in all areas. We turned to BDO for advice because we trusted that they would be accurate, timely, pragmatic and responsive. They exceeded our very high expectations. Matthew was excellent technically and a pleasure to work with.”

Ben Tolley, Finance Director, Clarity Capital Partners Limited

- “It goes without saying that we are extremely pleased with the support we received from BDO generally throughout the past year. From our first meeting at your EOT seminar a year ago we have been expertly guided through the process of bringing about what turned out to be a complex and unique transaction. We were impressed by the expertise and support you provided to us throughout the project lifecycle. In an area as complex as this, where we are dependent on the soundness of the advice we receive, it was critical to build confidence and trust that your approach was sound and workable in our specific situation. This culminated in your support on the day of the transaction when you presented to our full board and answered an array of detailed and technical questions covering the tax consequences and pitfalls associated with ongoing governance in an EOT structure. Building confidence with the non-execs over the structure of the transaction and the on-going tax implications as well as explaining the mechanics of an EOT structure were critical to us gaining the support needed to get the deal away”.

Paul Brock, CEO of BCS Consulting

- “The EOT team at BDO were exceptional. Their encyclopaedic knowledge of the scheme coupled with their foresight into the likely future direction it will take was second to none. There isn't another team on earth I'd have rather had helping us through to completion.”

Ian Witts, QuickThink Cloud Ltd