Growth share plan

Growth share plan

Growth shares allow private companies to share some of the growth in the value of the company with its key employees in a tax-efficient way. Growth shares are an extremely common way to lock-in, reward and incentivise employees, especially for those more mature companies that are looking for some form of corporate exit in the medium-term and that may not satisfy the qualifying conditions for the UK statutory share incentives. A growth share delivers value to the employee shareholder if the value of the company increases above a set ‘hurdle’. Returns to employees from growth shares are subject to capital gains tax (CGT).

How growth shares work

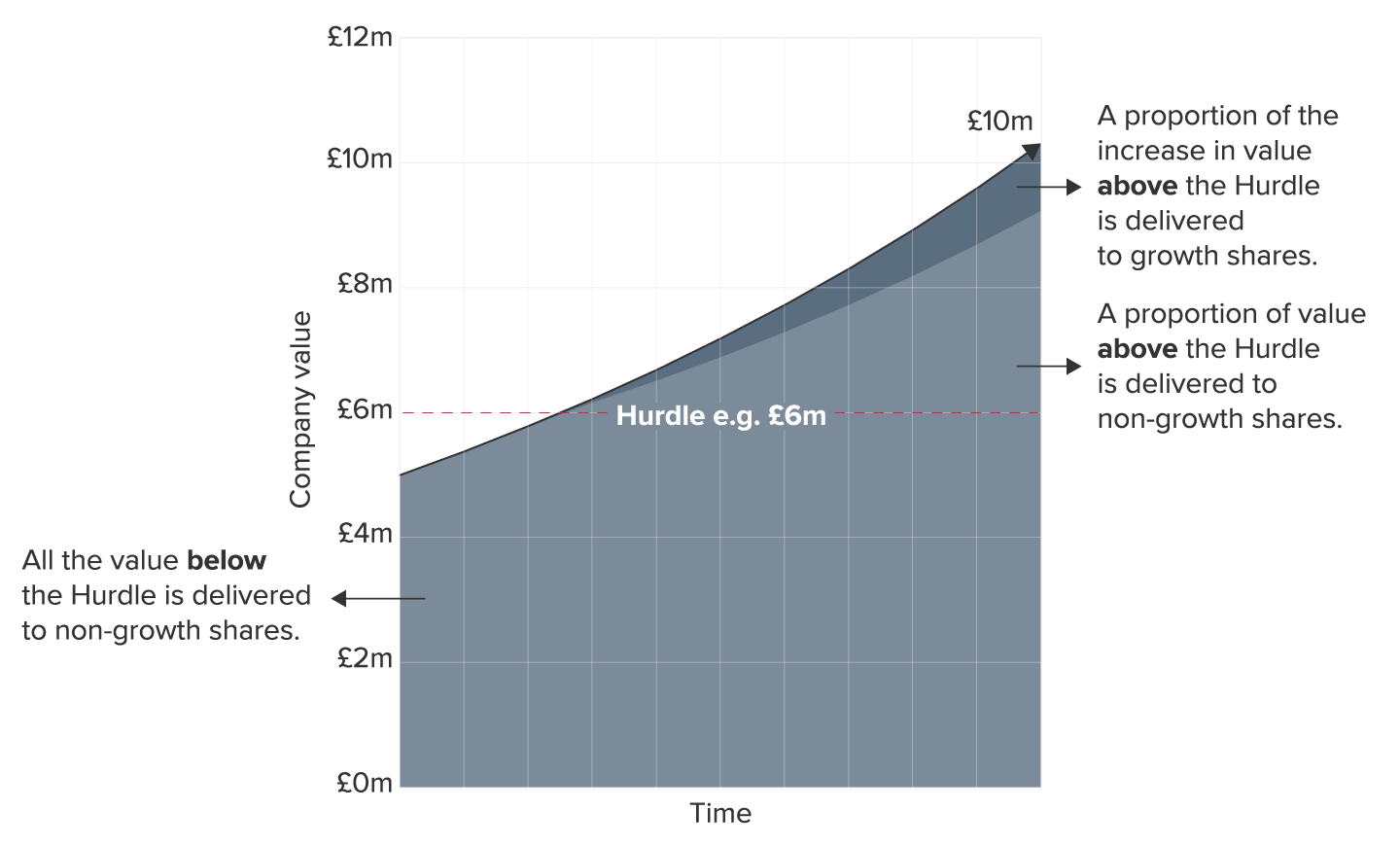

The company creates a new special class of share which allows the holder of the shares to participate in the growth in value of the company above a fixed “hurdle”. The growth shares do not benefit from any value below the hurdle. The equity hurdle will generally be set at a chosen premium above the market value of the company on the date the growth shares are awarded.

For valuation purposes, as the growth shares only receive economic returns if the hurdle is exceeded, the initial value of the growth share is usually much lower than existing ordinary shares. Therefore, the growth shares can be issued or transferred to employees for a relatively low issue or purchase price (or a low initial tax charge if the growth shares are acquired for no consideration).

The growth shares can be subject to restrictions on transfer, or forfeiture if specified conditions or targets are not achieved or the employee ceases employment.

The growth in the share value is subject to CGT, which is more attractive than the income tax that would apply to a cash bonus arrangement or non-tax advantaged share options. There is also no National Insurance Contributions liabilities on the increase in value of the growth shares which is a substantial saving to the employing company. This offers a significant benefit to employees and the employing company in high growth companies.

Example

A company is valued at £5m, and a manager is to be incentivised by being given up to 10% of the company value above the equity hurdle.

A new class of share is created which only benefits from capital value in excess of a £6m hurdle. These growth shares are entitled to 10% of the company value above the equity hurdle in excess of £6m.

The growth shares are valued. Due to the £6m ‘Hurdle’, the value of the growth shares is £10,000 and the manager buys growth shares for this price. Alternatively, the employee may receive the shares for no price and pay income tax on the £10,000 initial market value.

If the company grows in value and is sold for £10m, the value of the manager’s growth shares is 10% of the £4m value above the hurdle, being £400,000. If the company value’s value does not increase, the growth shares would not accrue any value. The growth in value of the employees' shares would be subject to CGT as opposed to income tax.

Benefits of growth shares

The participant becomes a shareholder immediately, aligning interests between existing shareholders and participants. In addition:

- Growth shares help preserve the current value and a percentage of the future growth in value up to the “hurdle” for existing shareholders, ensuring that this value is not diluted.

- The growth in the share value is subject to CGT rules, which is more attractive to employees than income tax / NIC treatment that applies to salary, bonuses and benefits. · Growth shares can be used with tax-advantaged EMI options, combining their commercial and tax benefits.

- Growth shares are commercially flexible and, when used independently outside of tax advantaged share plans, there is no value cap on growth shares that can be acquired.

- Growth shares can be made forfeitable on employees leaving, with relevant restrictions applying in relation to votes, dividends and other shareholding rights.

- Growth shares form part of the share capital of the company and are therefore governed by the company’s Articles of Association and subject to the same provisions as other shares on the sale of the company including tag and drag provisions.

Who can use Growth shares?

Growth shares are most commonly used by private companies, including start-up companies and private equity backed companies where there are substantial growth prospects.

As growth shares require a new class of shares to be created, they will not generally be appropriate for use by UK listed companies. However, growth shares may be created in a subsidiary of a listed company so that, subject to meeting performance targets or vesting conditions, the growth shares can be exchanged for shares in the listed company giving the employees a realisable asset.

For private and listed companies alike, the ability to ring fence the existing value makes the dilutive impact on existing shareholders far less than using ‘normal’ ordinary shares.

Caution needs to be applied to implement growth shares for EIS companies to ensure that the growth shares do not affect the EIS tax reliefs but with care, growth shares can be used by EIS companies.

Tax

On award of the growth shares:

The employee will pay income tax (and potentially employee’s NIC depending on whether the shares are, or deemed to be, “readily convertible assets”) on the market value of the growth shares on the date of receipt less any amounts paid for the growth shares. This would require a formal tax valuation to be undertaken and, depending on share rights, the tax value may be relatively low. Restricted securities tax elections will normally be entered into.

Disposal of the shares:

On disposal, capital gain tax (CGT) will be due on the amount by which the disposal proceeds exceed the base cost of the growth shares (the gain). CGT, currently at a rate of 24%, should apply to any gain arising to the employees.

In the above example, this would give rise to a CGT liability of £93,600 after deducting the manager’s base cost of £10,000 but ignoring the CGT annual exemption). A tax rate of 10% would apply if the conditions to claim Business Asset Disposal Relief (BADR) were met. Although the BADR rate is increasing to 14% from 6 April 2025 and to 18% from 6 April 2026, there still remains a differential to the main CGT rate.

Corporation tax and accounting:

There will usually be no corporate tax deduction available for the costs of the arrangement. Subject to auditor agreement, a growth share plan may result in an FRS 20/IFRS 2 accounting charge based on the fair value of the growth share awards.

Growth shares v unapproved options

The worked example below contrasts a non-tax-advantaged option plan with growth shares and shows that an advantageous employee tax and NIC result can be achieved.

In the share option example, the option exercise price is £0.60 per share and price at vesting is £1 per share. The option is granted over 1m shares.

In the growth share example, a participant acquires 1m growth shares. The rights of the growth shares entitle the holder to participate in 10% of the sale proceeds of the company above the current market value of the company of £6 million (ie above £0.60 per share on the basis that there are 10 million shares in issue). The participant is subject to income tax and NIC on the market value of the shares (£10,000, which is equal to the unrestricted market value at the date of acquisition).

In three years’ time, the company is sold for £10 million (£1 per share on the basis that there are still 10 million shares in issue). A holder of the growth shares is entitled to participate in 10% of the proceeds between £6 million and £10 million, with the initial £6 million ‘ring fenced’ for the current shareholders.

|

|

Non-tax-advantaged share options |

Growth Shares |

|---|---|---|

|

Employee |

||

|

Number of shares under award |

1,000,000 |

1,000,000 |

|

Income tax and employee’s NIC on grant @ 47% |

Nil |

£4,700 |

|

Income tax and employee’s NIC on exercise / vest @47% |

£188,000 |

Nil |

|

CGT on sale @ 24% |

Nil |

£93,600 |

|

Total employee tax cost |

£188,000 |

£98,300 |

|

New sale proceeds due to employee after funding exercise price and tax |

£212,000 |

£301,700 |

|

Employer |

||

|

Employer’s NIC at 15% (rate applying from April 2025) |

£60,000 |

£1,500 |

|

Corporation tax relief @ 18% (on amounts subject to income tax and on employer’s NIC) |

(115,000) |

(£2,875) |

|

Net employer tax cost |

(£55,000) |

(£1,375) |

**CGT figures include a deduction for the base cost but ignores the annual exemption other reliefs.

Other uses of a growth share plan

As well as being used to lock-in, reward and incentivising employees, growth shares can be used for effective inheritance and succession planning.

Instead of awarding growth shares to employees, those shares potentially could be given to family members, directly or through a trust arrangement, for the next generation. This has the effect of transferring all or part of the future growth in the value of the company to other family members, whilst the current generation retain the value created thus far.

The value of the gift will be limited for inheritance tax purposes. This is particularly useful in cases where a shareholding would not qualify for inheritance tax business relief (such as shares in investment companies). Read more about IHT business relief here.

Expert advice on Share Plans and Incentives

Despite the increase in (a) employer’s NIC to 15% (from April 2025); (b) top rate of capital gains tax to 24%; and (c) Business Asset Disposal Relief to 18% (by April 2026), share-based incentives remain an extremely attractive way to retain and incentive key employees in a tax efficient way which can be aligned with the company’s key commercial objectives.

If you have any questions about growth shares, or any other share plans for your business, please get in touch – our team of specialists will be happy to help you.