Incoterms Explained: Trading globally, contracts and customs formalities – how incoterms can help

Incoterms Explained: Trading globally, contracts and customs formalities – how incoterms can help

Global Trade Compliance: what is it and why is it important?

There are an ever-increasing range of trade compliance obligations that international businesses need to be aware of and comply with to move their goods from A to B. Failure to comply can result in fines, penalties, delays in the movement of goods and potentially damage to the business reputation.

What are Incoterms?

Incoterms are a set of globally applied standard trading terms to help facilitate worldwide trade between contracting parties (the seller and buyer). The standard international trading terms are administered by the International Chamber of Commerce (ICC): they were first codified in 1936 and have been updated periodically ever since (the last time was in 2020).

Incoterms play an intrinsic role in the global movement of goods, ensuring that there are standard responsibilities for the buyer and seller – but they are often not applied correctly. This can lead to disagreements and expensive litigation between the buyer and seller as to their obligations, risks and costs.

International businesses must understand and apply these trade terms correctly in their contractual arrangements. Incoterms are particularly relevant for VAT and customs duties, as the Incoterms can establish which party is responsible for submitting customs declarations, accounting for VAT and paying import duties (customs, excise and VAT) to the importing country Tax Authority.

Incoterms rules

There are 11 Incoterms rules, which are designed to reflect common business practices when moving goods between sellers and buyers, and they cover a number of key points, including:

- Obligations of the parties relating to the carriage and insurance of the goods that are being sold by the seller to the buyer and which party submits the customs declarations at export and import

- Risk between parties, i.e. the point of delivery

- Costs to be borne by the parties: which party is responsible for the costs associated with moving the goods from the seller to the buyer - i.e. freight, insurance, packing, unloading and documentation preparation.

However, Incoterms are not contracts of sale and, therefore, whilst they can indicate an intention when to pass title to the goods it is the contract of sale that determines this point. Best practice is to clearly align both the incoterms used on customs declarations and shipping documentation with the incoterm quoted in the contract of sale.

We often see disputes on the interpretation of an incoterm by a buyer and a seller when they both believe it applies slightly differently. Therefore, the more explicit a contract of sale is the better to avoid any misunderstanding and potential dispute.

Incoterm Groups

For ease of reference, Incoterms have been put into four groups: E, F, C and D.

From the seller’s perspective the ‘E’ group is the most beneficial and least onerous, but for the buyer this is the most risky type of incoterms. The ‘D’ group of incoterms is the least beneficial for the seller and the least risky for the buyer, so there is always a lot of negotiation to agree contract terms and incoterms used.

There are a further three ‘F’ rules and four ‘C’ rules, which vary the obligations between the seller and buyer.

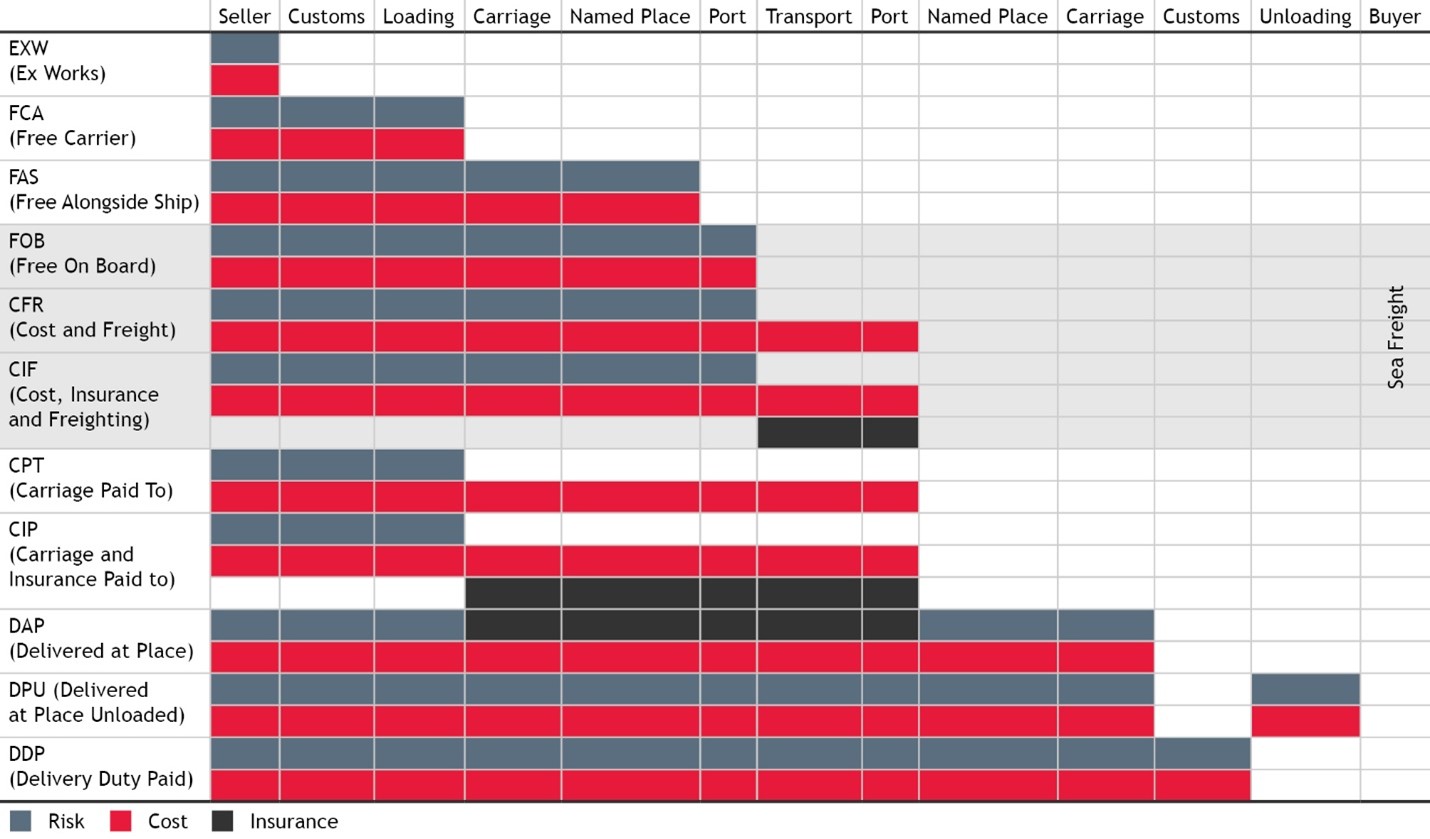

The diagram below shows how obligation, risk and cost are allocated between the seller and buyer under each rule.

Some key aspects to be aware of:

DPU (Delivered at Place Unloaded)

DPU incoterms are designed to reflect the commercial reality that goods can be delivered to any place - not just a terminal - and to re-emphasise that it is the seller’s responsibility to unload the goods under this Incoterm.

DAP (Delivered at Place)

DAP incoterms are designed to reflect the commercial reality that the goods can be delivered and contract completed when arriving at a designated place. However, we often see this term used without clarification of the destination. This should be clearly stated on the commercial documentation and in the contract.

FOB (Free on Board)

FOB incoterms are designated for inland waterway and high sea logistics, where the sellers responsibility and risk towards the goods ends when they are loaded onto the vessel of transport. The buyer then has the risk of the goods during transport to their premises in final country of destination.

Bills of Lading and the FCA (Free Carriage Alongside) rule

Under this rule, the seller’s delivery obligation ends before the goods are loaded onto the vessel and so the seller is able to obtain an ‘on board bill of lading’ from the carrier (which it may need for payment and contractual purposes).

Option to have different insurance cover under ‘C’ terms

Under CIF (Cost Insurance Freight) the seller has to obtain cargo insurance that meets the minimum insurance cover as provided by the Institute Cargo Clause ‘C’.

Under CIP (Carriage and Insurance Paid), the seller must adhere to the higher Clause A standards.

Introduction of security-related elements in carriage obligations and costs reflecting security concerns in the global supply chain, there are security-related obligations for each Incoterm, and the costs incurred are set out.

Incoterms challenges

Lack of specificity in the use of Incoterms often causes confusion. Incoterms are intended to provide structure around the roles of buyers and sellers across all global transactions and supply chains so, in reality, they cannot cover all eventualities. Parties should, therefore, introduce additional detail where it is prudent to do so - for example, naming ports or places for delivery.

In many instances, where the seller is obliged to deliver the goods (at which point the risk passes), and where the seller is obliged to arrange carriage to, will be different locations. Therefore, the use of named locations in the Incoterms will help to clarify the position.

Commercial realities

In some instances, the use of specific Incoterms hinders good commercial practice - for example, under the incoterm “Ex Works” (EXW) rule, the seller merely has to put the goods at the buyer’s disposal. However, in practical terms, this raises questions as to who has the obligation and bears the risk of certain activities such as loading the goods. Technically it is not the seller who bears this risk but, if this activity is done on the seller’s premises, in reality it may well be the seller who loads the goods. If the seller loads the goods and something goes wrong, which party bears the risk and obligation for any damage?

Another risk of EXW is that as the seller, you will need evidence of export to zero rate the sale as exported goods. However, often the seller faces difficulty in obtaining the export evidence e.g. export declaration and shipping documentation from the buyer. This can cause a risk and enable HMRC to raise a VAT assessment against the seller when no evidence of export is held.

Incoterms Post-Brexit

An example of how Brexit has affected incoterms can be seen in the use of the incoterm “Delivered Duty Paid” (DDP), where the seller is based in the UK and the buyer is in the EU. Under these terms, the seller will need to complete both the UK export customs declaration and the EU import declaration.

However, in order to do the latter, the seller will be required as a minimum to hold either an EU VAT registration, EU EORI number or appoint a fiscal representative in the EU. This may not be commercially practicable and has caused lots of sellers to move away from DDP when they are not established in the EU country of import.

Understanding the VAT and duties consequences of Incoterms for your business and ensuring that the required accounting and reporting systems are in place will help to avoid unwelcome surprises or unexpected liabilities.

How we can help

Our established Customs, Excise and International Trade Team made up of lawyers, ex-HMRC and industry experts. We can assist you in identifying the correct incoterms for you to use in your contracts, help mediate disputes between your business and your customers and additionally, provide defence services in relation to enquiries from HMRC or other global tax authorities.