James Egert

Establish what you know about the management of your tax risk and how to address gaps and weaknesses. Your Tax Risk Review will take into account that tax risk will more often than not arise from the activities of the wider business as well as from the tax or finance function.

Consider the following questions:

We have an established approach to reviewing tax risk management. We use facilitate structured tax risk discussion workshops to clarify and determine your approach to tax risk. Questionnaires and other digital tools will be used to assess and benchmark your tax risk controls and framework. Our experience is that creating an environment of openness and knowledge sharing is key to delivering the right outcomes for your business.

A collaborative approach that includes the wider business, not just tax and finance, delivers better outcomes. By building a consensus around your approach to tax risk, you will be in a better position to leverage work being done well and to agree positive recommendations where improvements or additional rigour are needed.

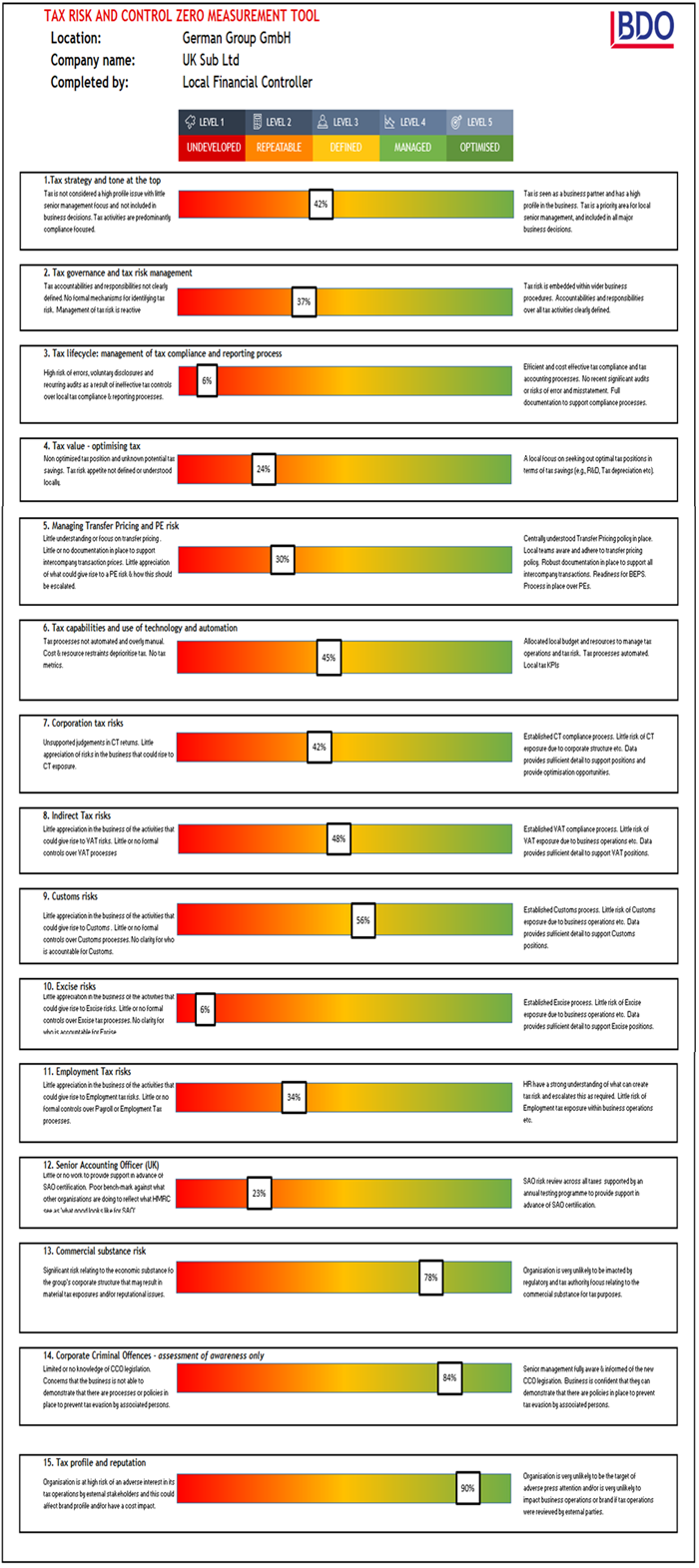

We use various tax risk questionnaires and tools to benchmark your tax risk and control framework. We use a Tax Risk and Opportunity Questionnaire and a Tax Data Collection Template. However, the core of this digital approach is the online ‘Tax Risk and Control (TRAC).

This provides you with an immediate and accessible benchmark of the relative strengths of your tax risk and control framework, aligned to a five stage maturity model. It covers a broad range of tax management issues including;

You will receive a comprehensive Tax Risk Report centred on a tax risk and control matrix. The report will cover three areas; prioritised tax risks, identification of gaps in your tax control framework and practical recommendations on improving it.

You will be able to use our recommendations to effectively improve your tax risk governance, management and reporting. You will be given both ‘quick win’ and longer-term recommendations.