Kamal Kataria

VAT compliance can be onerous and many businesses find that effectively and efficiently managing your VAT obligations is simply not possible without the right technology stack. We can help you identify and understand any weaknesses in your current technology and provide an objective, external assessment of your compliance risks and opportunities to reduce them. Knowing how to evolve your software to support your business requires a deep understanding of how the VAT software market is evolving and experience of implementing new and emerging technologies – we can guide you every step of the way.

Our expert team of VAT technology specialists come from a wide range of professional backgrounds; from careers in Tech to those that previously focused on traditional VAT advisory sevices. This depth and breadth of experience enables us to advise you on optimising your software.

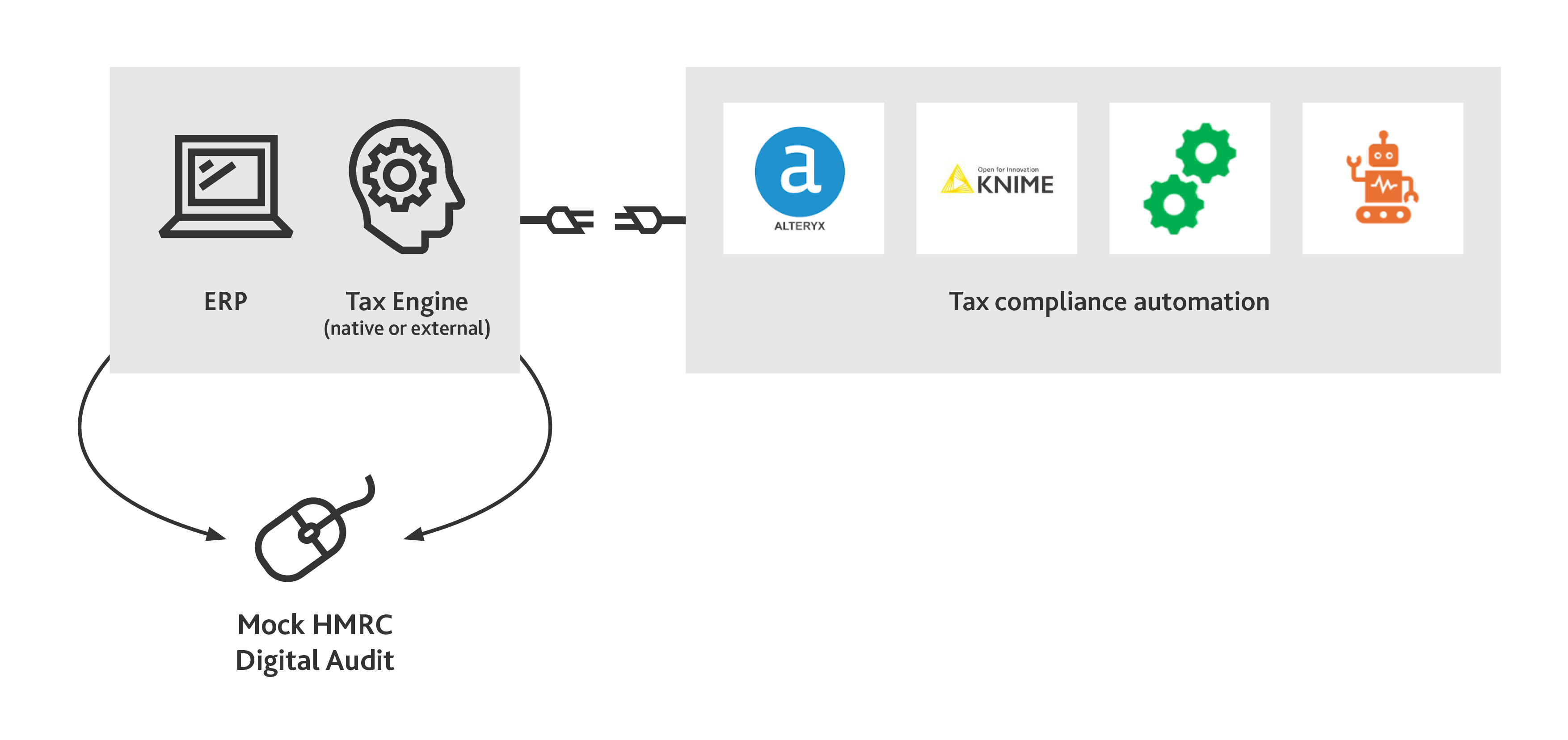

Our approach is systems and software agnostic. We will help you find the right technology solutions for your business. We review your current set up with the primary goal of optimising rather than replacing or upgrading. This can be as simple as harnessing what you already have, such as maximising the use of your Microsoft suite to reconfiguring your native tax engines within your existing ERP systems.

Where an upgrade/extension is the best solution for you, our specialists will collaborate with you to deploy the right best-in-class software to suit your needs.

We always work with your local VAT advisory team to ensure that any remediation of your VAT technology is delivered seamlessly and supports your wider business goals.

Where you maintain your own accounting records and VAT processes, in house, we focus our assistance in the following areas: